Wondering how New York lawyers handle uninsured car accident claims?

Getting hit by an uninsured driver in New York can be financially devastating—medical bills, lost wages, and car repairs pile up fast, and there’s no insurance to cover the costs. If your injuries are serious, the stakes are even higher. How can you recover compensation when the at-fault driver has no coverage?

New York’s no-fault insurance (PIP) covers initial medical expenses but does not compensate for pain and suffering. If you need full compensation for lost income, medical treatments, or permanent injuries, you’ll need Uninsured Motorist (UM) or Underinsured Motorist (UIM) coverage.

The Problem? Insurance companies don’t make it easy. Expect delayed settlements, denied claims, and legal loopholes designed to minimize payouts. Even though New York requires insurance (VTL § 312), thousands of drivers still operate without coverage leaving innocent accident victims struggling to recover. Knowing how New York lawyers handle uninsured car accident claims can make all the difference.

How a New York Car Accident Lawyer Helps

- Uncovering the truth: Gathering police reports, witness statements, and accident reconstructions.

- Fighting back against insurers: Demanding full compensation and refusing lowball offers.

- Suing the at-fault driver if needed: Pursuing all legal avenues to recover what you’re owed.

According to the Insurance Research Council (IRC), victims with a lawyer recover up to 3.5 times more in settlements.

Every day you wait, insurers build a case against you. Don’t let them take advantage of you. Call a New York car accident lawyer today at Stanley Law Offices for a free consultation and start fighting for the compensation you deserve.

How New York Car Accident Lawyers Handle Uninsured Motorist Claims

Without a lawyer, insurers will take advantage of you. A New York car accident attorney fights back – handling legal battles, pressuring insurers, and securing the maximum compensation for medical expenses, lost wages, and other damages.

Car accident lawyers in New York handle uninsured motorist claims in the following ways:

Investigates Fault & Liability in an Uninsured Car Accident

Establishing fault is critical in UM cases. Lawyers gather:

- Police reports & traffic camera footage to prove negligence.

- Witness statements for independent verification.

- Accident reconstruction reports to challenge insurer disputes.

Files an Uninsured Car Accident Claim in New York

To file an uninsured car accident claim in New York, it requires strict compliance with claim deadlines:

- Accidents must be reported within 30 days for UM/UIM claims.

- All forms and medical records must be accurately submitted.

- Errors can result in claim denials.

Negotiating with Insurance Companies for a Fair Payout

Insurers frequently minimize payouts by:

- Disputing injury severity or claiming pre-existing conditions.

- Delaying claim processing to pressure victims.

- Offering lowball settlements below actual damages.

Negotiating with Insurance companies for a fair payout can be challenging. You may need a car accident lawyer in such case. A car accident lawyer NY challenges these tactics with strong medical evidence, wage loss reports, and expert testimony.

Taking Legal Action Against an Uninsured Driver

If UM coverage is insufficient, a lawyer may sue the at-fault driver or identify other liable parties, such as:

Employers (if the driver was on duty).

Vehicle owners (if the car was borrowed).

However, uninsured drivers often lack assets, making a recovery difficult unless they own property or have garnishable wages.

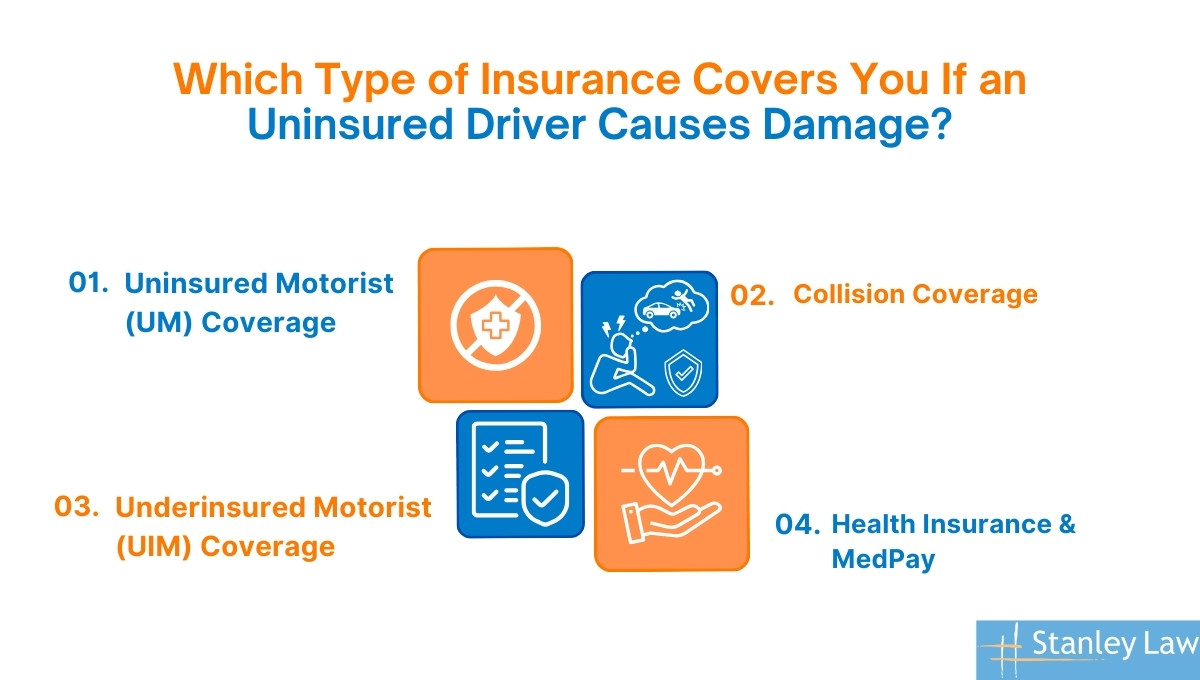

Which Type of Insurance Covers You If an Uninsured Driver Causes Damage?

Uninsured Motorist (UM) Coverage

UM coverage provides financial protection if an at-fault driver has no insurance or flees the scene (hit-and-run).

New York requires UM coverage for all drivers.

- Covers: Medical expenses, lost wages, pain & suffering, and funeral costs (for fatal accidents).

- Without UM: Victims must rely on health insurance or collision coverage.

Underinsured Motorist (UIM) Coverage

UIM coverage fills the gap when an at-fault driver’s insurance is insufficient.

- Covers: Remaining medical bills, additional lost wages, and pain & suffering (if applicable).

- Without UIM: Victims must pay out-of-pocket or pursue legal action.

Collision Coverage

Worried about car repairs? If you have collision coverage, your insurance pays for vehicle repairs, no matter who was at fault.

- Not mandatory but often required for financed cars.

- Covers: Car repair costs or full replacement (if totaled).

- Without collision coverage: Victims must pay for repairs or sue the at-fault driver.

Health Insurance & MedPay

Health insurance and Medical Payments (MedPay) coverage help with medical expenses.

- MedPay is optional in New York.

- Health insurance covers: Hospital bills and surgery but not lost wages.

- MedPay provides: Immediate coverage without deductibles or co-pays.

- Without MedPay: Victims must rely on out-of-pocket payments or legal action.

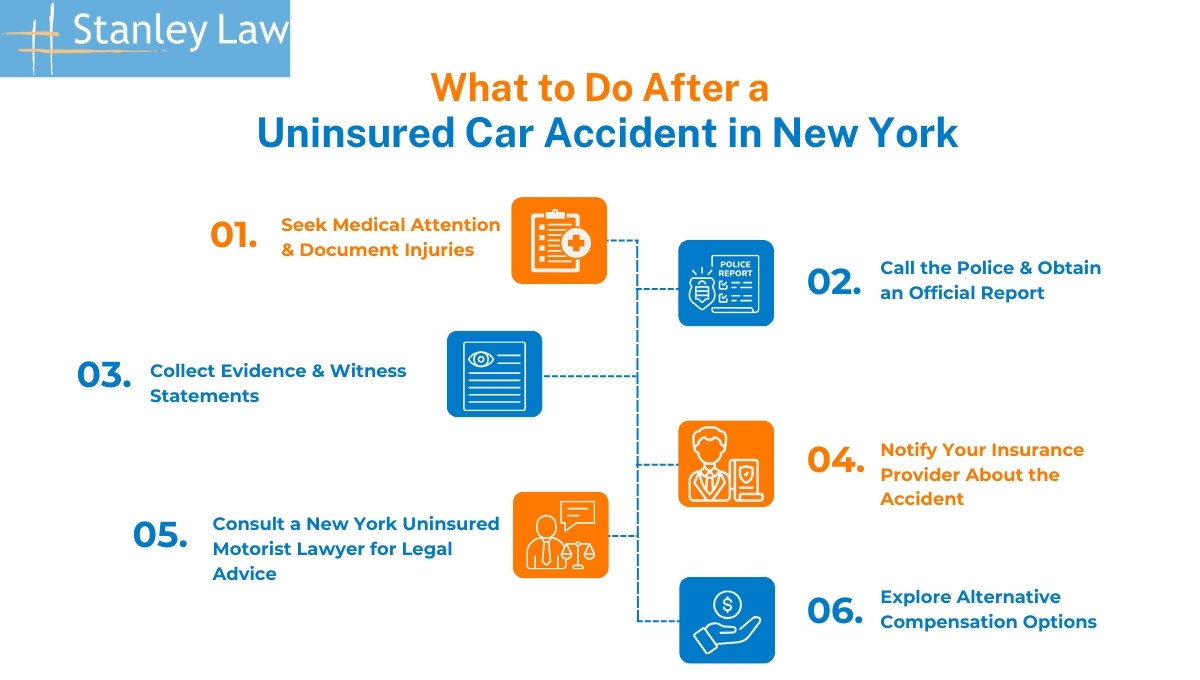

What to do After an Uninsured Car Accident in New York?

Following these steps protects your rights and increases your compensation chances:

Step 1: Seek Medical Attention & Document Injuries

- Call 911 immediately for emergency care.

- Visit a doctor even if injuries seem minor.

- Keep all medical records and bills for your claim.

Timeframe: Immediate emergency care, follow-ups within days/weeks.

Mistakes to avoid: Delaying treatment or failing to document injuries

Step 2: Call the Police & Obtain an Official Report

- New York law requires accident reporting for injuries or damages over $1,000 (Vehicle & Traffic Law § 605).

- Request a copy of the police report.

Time Frame: 30 minutes–1 hour at the scene, a few days to obtain the report.

Mistakes to Avoid: Leaving without reporting or providing incomplete details.

Step 3: Collect Evidence & Witness Statements

- Take photos/videos of the accident, injuries, and vehicle damage.

- Record witness statements & contact information.

- Time Frame: 15-30 minutes at the scene.

- Mistakes to Avoid: Forgetting to take photos or not getting witness details.

Step 4: Notify Your Insurer Provider About The Accident

- File a UM claim within 30 days to avoid denial.

- Provide all required documents (police reports, medical records, etc.).

Time Frame: A few minutes to an hour for the initial call.

Mistakes to Avoid: Admitting fault or accepting a low settlement.

Step 5: Consult a New York Uninsured Motorist Lawyer for Legal Advice

- Most auto accident lawyers offer free consultations and work on contingency (no upfront fees).

- Present all case documents and discuss legal options.

Time Frame: 30-60 minutes for the initial consultation.

Mistakes to Avoid: Waiting too long to seek legal help.

Step 6: Explore Alternative Compensation Options

- Review all insurance coverage (UM, UIM, MedPay).

- Consider suing the at-fault driver (if they have assets).

Time Duration: Varies depending on the legal action needed.

Mistakes to Avoid: Assuming there’s no way to recover compensation.

What Are the Legal & Financial Risks of Uninsured Car Accidents in New York?

Uninsured car accidents in New York cause serious financial and legal consequences, affecting both victims and at-fault drivers.

For Victims:

- Medical bills, vehicle repairs, and lost wages can pile up.

- Limited insurance options make compensation difficult without UM/UIM coverage.

For At-Fault Uninsured Drivers:

- Fines, license suspension, and personal liability for damages.

- Risk of wage garnishment or asset seizure if sued.

Insurance Company Tactics:

- Delays claim denials, and lowball settlements to minimize payouts.

How Lawyers Help:

- Negotiate settlements, file lawsuits, and handle legal deadlines.

Consequences of Underestimating Risks:

Debt, unpaid medical bills, and denied claims without proper legal action.

Is Uninsured Motorist Coverage Required in New York?

Yes, New York law mandates Uninsured Motorist (UM) coverage for all registered vehicles. This coverage protects you if you’re injured by an uninsured or hit-and-run driver. The minimum required limits are $25,000 per person and $50,000 per accident for bodily injury.

How Does New York’s Pure Comparative Negligence Law Affect Your Claim?

In New York, you can recover damages even if you are 99% at fault. However, your compensation is reduced by your percentage of fault. For example, if you’re 30% at fault in a $100,000 claim, you receive $70,000.

What Happens if You File a Car Accident Claim without New York Uninsured Motorist Attorney?

Insurance companies pressure victims into accepting low settlements when they don’t have a lawyer. Other Common mistakes victims make while filing a car accident claim include:

- Accepting the first settlement offer, which is often far below the actual damages.

- Failing to provide strong evidence, leading to a claim denial.

- Missing legal deadlines, preventing recovery.

Who Pays for Damages if an Uninsured Driver Causes a Hit-and-Run in New York?

If the at-fault driver flees, compensation usually comes from:

- Uninsured Motorist (UM) coverage: Pays for injuries and damages.

- Collision coverage: Covers vehicle repairs.

- Crime Victims Compensation Fund: Helps in severe injury cases.

Who Pays for Medical Bills & Damages If Both Drivers Are Uninsured?

If neither driver has insurance, the responsibility falls on:

- Personal finances: Paying medical bills and repairs out of pocket.

- Health insurance: Covers treatment but not lost wages or vehicle damage.

- Civil lawsuits: Suing the at-fault driver, though recovery is unlikely if they lack assets.

How Insurance Companies Trick Victims into Lower Settlements?

- Blaming You for the Crash: They’ll argue you were partially at fault, even if there’s no evidence.

- Downplaying Your Injuries: Expect them to claim your pain is from a past condition, not the accident.

- Delaying Payouts: Using prolonged investigations to pressure victims into settling for less.

- Lowball Settlements: Offering far less than the claim’s actual value.

Hiring a lawyer helps to counter these tactics by:

- Collecting strong evidence to prove fault and injury severity.

- Pushing back against lowball offers with expert testimony and legal arguments.

- Filing a lawsuit ( if necessary).

Take Action Now: Protect Your Rights

Navigating an uninsured motorist claim alone can cost you time, money, and peace of mind. Insurance companies will use every tactic to minimize your settlement, leaving you with unpaid bills and financial stress. But you don’t have to face this battle alone.

A skilled New York car accident lawyer can fight back, ensuring you receive the compensation you deserve. Time is critical—deadlines for uninsured motorist claims are strict, and waiting too long can hurt your case.

Schedule a free consultation with Stanley Law Offices today.