Yes. Social Security Disability Insurance (SSDI) is taxable if your total income exceeds IRS thresholds. In contrast, Supplemental Security Income (SSI) is not taxable. The IRS counts half of your SSDI plus any wages, self-employment, or interest to calculate what’s taxable.

If you earn more than $25,000 as a single filer or $32,000 if married filing jointly, up to 85% of your SSDI may be taxed.

Are Social Security Disability Benefits Taxable for everyone? Not always. But many recipients receive unexpected IRS notices or SSA-1099 forms they didn’t anticipate.

Misreading IRS disability income tax rules can result in overpaying or underreporting.

At Stanley Law Offices, we help you avoid mistakes and protect your SSDI income before tax problems grow.

What Makes Social Security Disability Benefits Taxable?

Social Security Disability benefits are taxable when your combined income exceeds IRS limits. Combined income includes your adjusted gross income, nontaxable interest, and half of your SSDI benefits.

Which Social Security Benefits Are Taxed: SSDI vs. SSI?

SSDI (Social Security Disability Insurance) is taxable if your combined income exceeds IRS thresholds: $25,000 for single filers, $32,000 for joint filers. SSDI is based on your work history and the payroll taxes you’ve paid.

SSI (Supplemental Security Income) is never taxable. It’s a needs-based program for individuals with limited income and assets, and the IRS does not tax SSI under any condition.

Many people confuse SSDI and SSI because both come from the Social Security Administration and support those with disabilities. But tax treatment is very different. If you receive SSDI along with income from work or a spouse, a portion of your benefits may be counted as taxable income.

How Does the IRS Calculate Taxable SSDI?

The IRS calculates whether your SSDI is taxable by using your combined income. Combined income includes:

- Your adjusted gross income (AGI).

- Any nontaxable interest you received.

- 50% of your SSDI benefits.

If you’re single and your combined income exceeds $25,000, or you’re married filing jointly and it exceeds $32,000, a portion of your SSDI becomes taxable.

This formula helps the IRS decide if 50% or 85% of your SSDI should be counted as taxable income.

How Much of Your SSDI Can Be Taxed: 50% or 85%?

The IRS taxes up to 50% or 85% of your SSDI, depending on your combined income.

- Up to 50% of your SSDI is taxable if you’re single with a combined income between $25,000 and $34,000, or married filing jointly with a combined income between $32,000 and $44,000.

- Up to 85% is taxable if you’re single with income over $34,000, or married filing jointly over $44,000.

Example:

If you’re single and earn $30,000 in combined income, about $7,000-$8,000 of your SSDI might be considered taxable income.

This doesn’t mean you’re paying 85% in taxes, just that a portion of your SSDI is added to your taxable income and taxed at your usual rate.

How to Report SSDI Income on Your Tax Return

Reporting SSDI income requires the SSA-1099 form and accurate entries on IRS Form 1040. Use the right lines and amounts based on your income and filing status to avoid errors or IRS notices.

What Tax Forms Do SSDI Recipients Receive from the IRS?

If you received SSDI last year, the Social Security Administration will send you Form SSA-1099 each January. This form shows the total amount of SSDI you received, listed in Box 5.

Box 5 is the figure you’ll use to determine if your SSDI is taxable. Only part of this amount may be taxable, depending on your combined income. A common mistake is assuming the entire amount in Box 5 is taxable; it’s not.

If you lost your SSA-1099, you can request a replacement through your mySocialSecurity account or by calling SSA. Entering incorrect SSA-1099 figures can lead to IRS errors and unexpected tax bills.

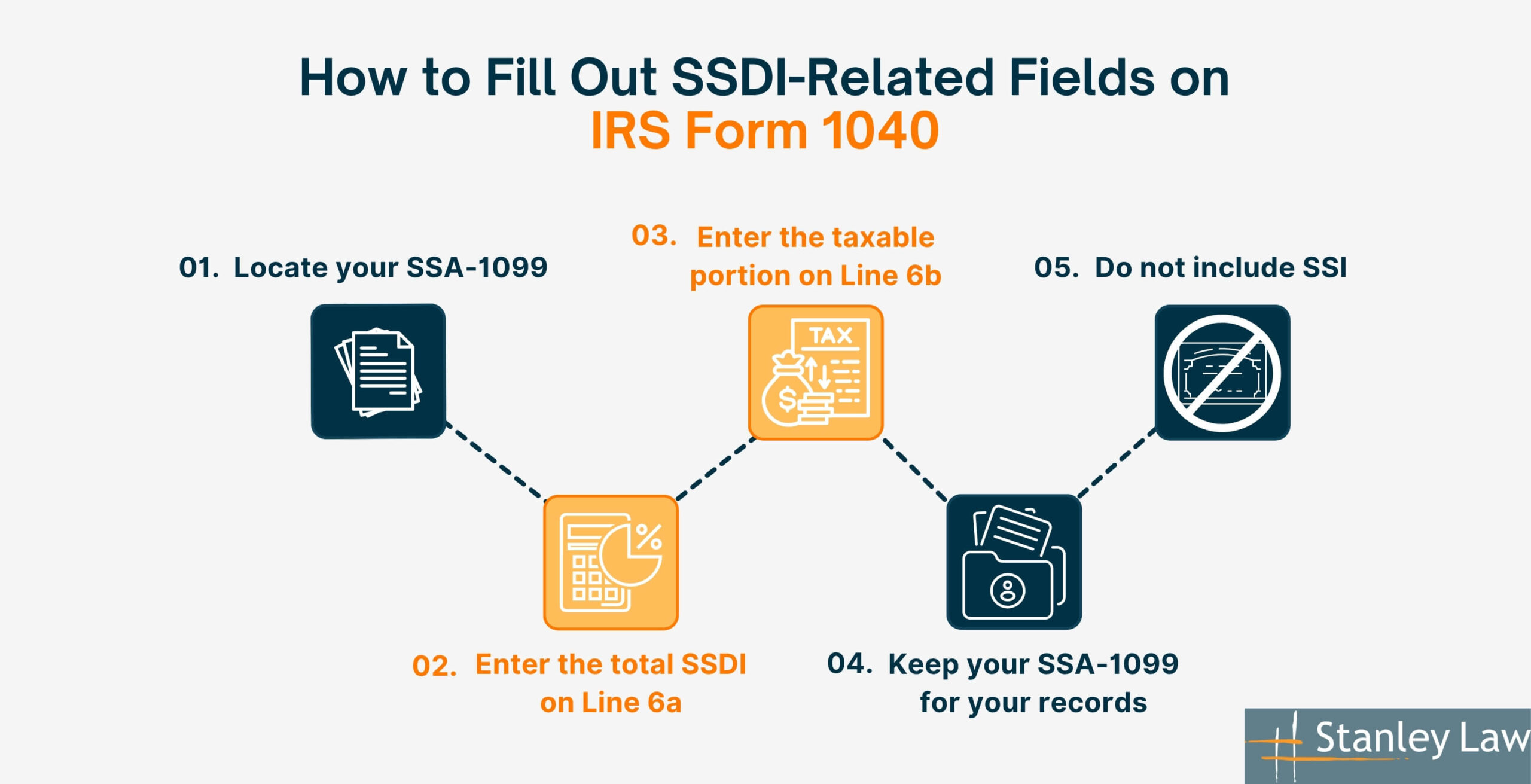

How to Fill Out SSDI-Related Fields on IRS Form 1040

To report SSDI income, follow these steps using IRS Form 1040:

- Locate your SSA-1099: Use the amount in Box 5 as your starting figure.

- Enter the total SSDI on Line 6a: This line reports your full benefit amount.

- Enter the taxable portion on Line 6b: If part of your SSDI is taxable, record it here using Publication 915 or the IRS worksheet.

- Keep your SSA-1099 for your records: Don’t send it with your return, but retain it in case the IRS requests it.

- Do not include SSI: SSI is not taxable and should not appear on your return.

Filing accurately avoids IRS issues and ensures you only pay tax on the portion of SSDI that applies.

How SSDI Back Pay and Lump-Sum Payments Affect Taxes

Lump-sum SSDI back pay is often reported in a single year, even if it applies to earlier years. Without proper allocation, this can increase your taxable income and result in higher IRS liability.

Allocating SSDI Back Pay Across Tax Years

SSDI back pay is often issued as a lump sum but usually covers multiple years of past benefits. SSA-1099 Box 5 reports the entire lump sum as income for the year it was paid, not the years it applies to.

Example:

- Jane receives $24,000 in SSDI back pay for 2021, 2022, and 2023.

- Her 2023 SSA-1099 shows the full $24,000 in Box 5.

- Reporting all $24,000 in 2023 inflates her income and may result in up to 85% of her SSDI being taxable.

- IRS rules allow income reallocation: Jane can spread the $24,000 across the years it was owed using Publication 915 guidelines.

If filed incorrectly, Jane can submit Form 1040-X to amend her tax return and reduce the tax owed. Properly allocating SSDI back pay can minimize tax liability and avoid triggering unnecessary IRS taxes.

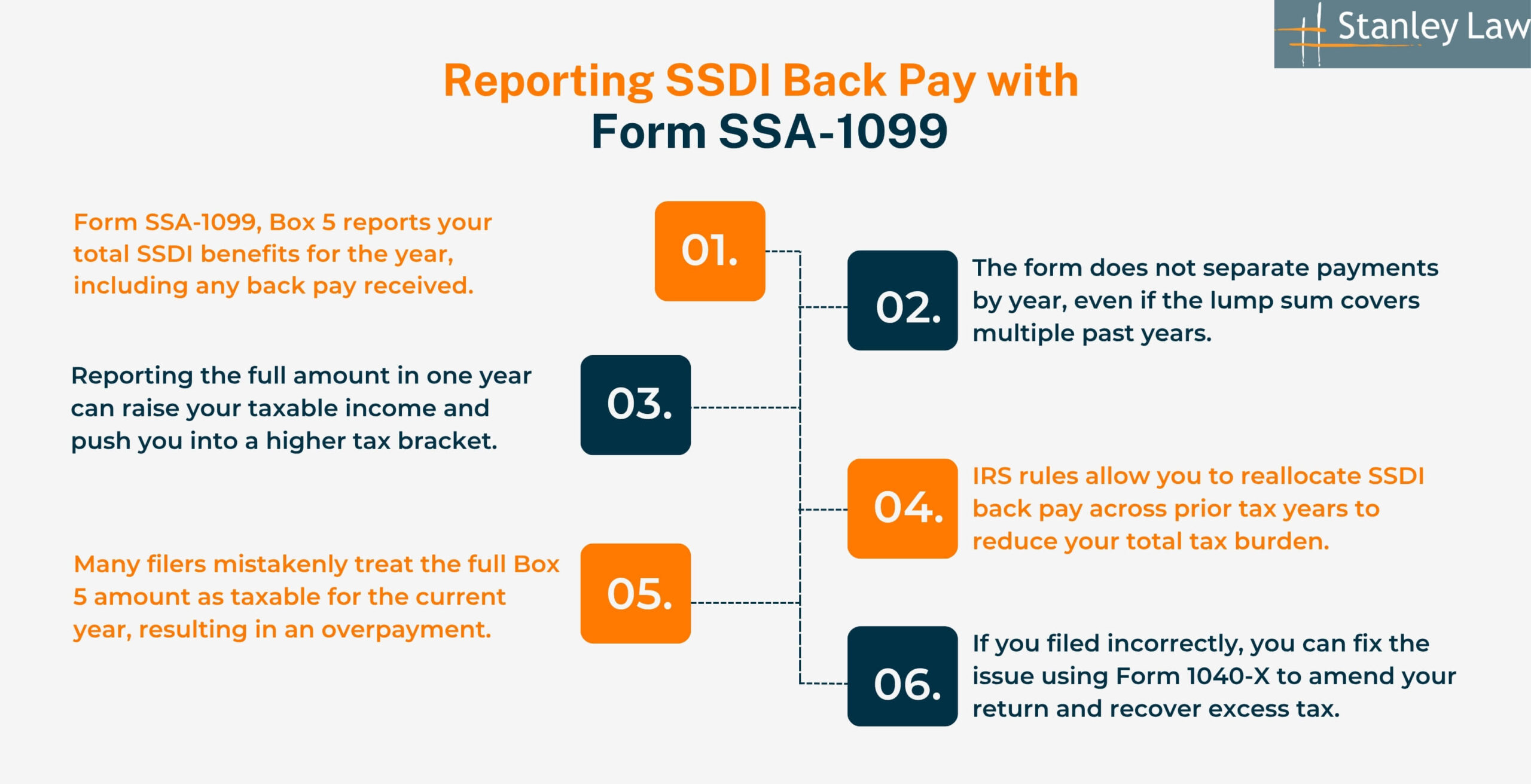

Reporting SSDI Back Pay with Form SSA-1099

Understanding how Form SSA-1099 reports SSDI back pay is key to avoiding unnecessary taxes. Here’s what to watch for:

- Form SSA-1099, Box 5 reports your total SSDI benefits for the year, including any back pay received.

- The form does not separate payments by year, even if the lump sum covers multiple past years.

- Reporting the full amount in one year can raise your taxable income and push you into a higher tax bracket.

- IRS rules allow you to reallocate SSDI back pay across prior tax years to reduce your total tax burden.

- Many filers mistakenly treat the full Box 5 amount as taxable for the current year, resulting in an overpayment.

- If you filed incorrectly, you can fix the issue using Form 1040-X to amend your return and recover excess tax.

Can You Work While Receiving SSDI and Still Owe Taxes?

Yes, working while on SSDI can raise your taxable income even if you still qualify for benefits. The IRS and SSA use different rules, and that overlap can trigger taxes.

Tax Effects of a Trial Work Period or SGA

Here’s how the Trial Work Period (TWP) and Substantial Gainful Activity (SGA) affect your SDI taxes:

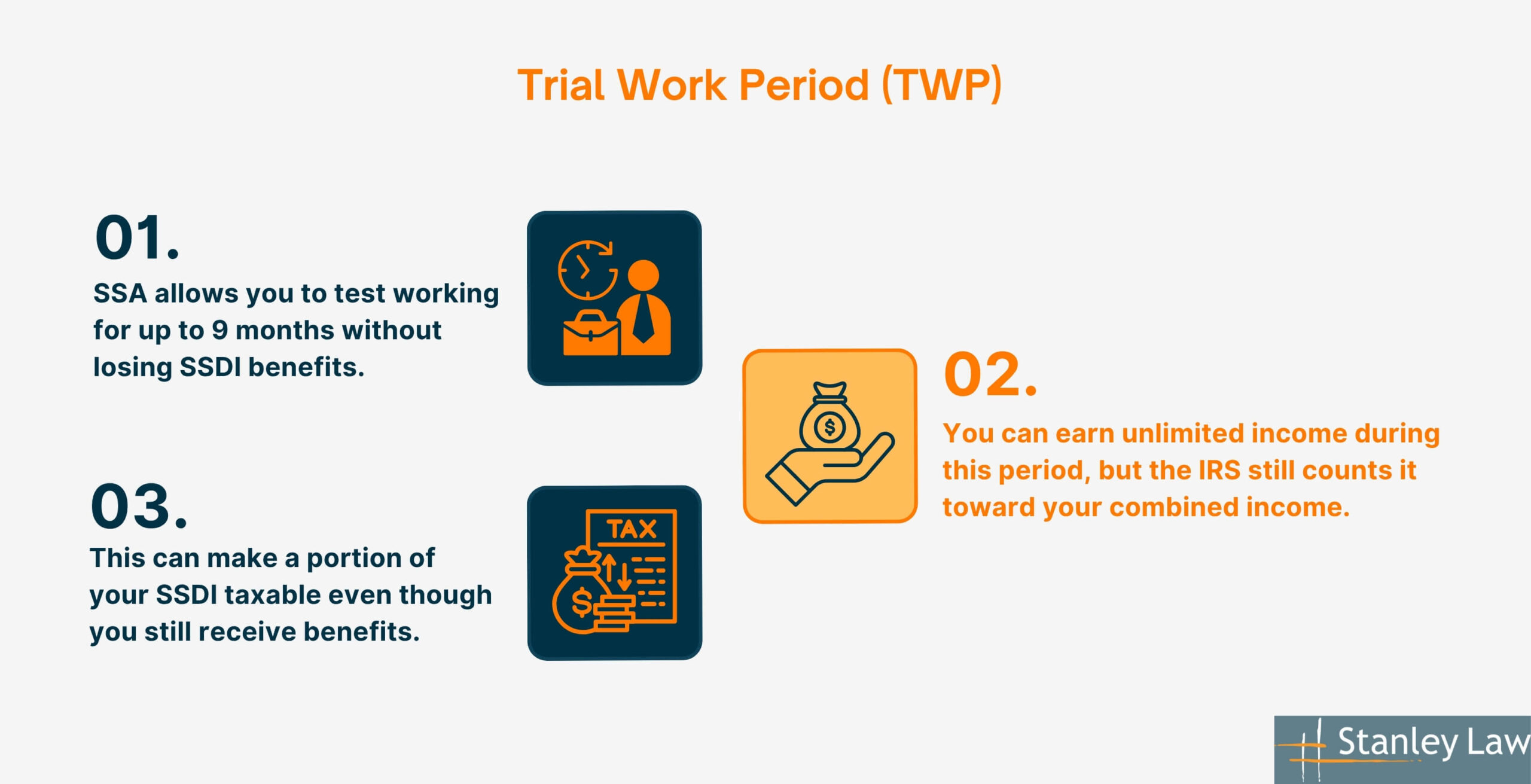

Trial Work Period (TWP)

- SSA allows you to test working for up to 9 months without losing SSDI benefits.

- You can earn unlimited income during this period, but the IRS still counts it toward your combined income.

- This can make a portion of your SSDI taxable even though you still receive benefits.

Substantial Gainful Activity (SGA)

- After the TWP ends, if your earnings exceed $1,620 per month in 2025 (non-blind), SSA may pause or stop benefits.

- The IRS counts these earnings, which can raise your combined income and trigger SSDI taxation.

Tax triggers to watch

- High earnings during your Trial Work Period.

- Income above the SGA limit.

- Receiving SSDI while working part-time or full-time.

Taxation of Self-Employment Income While on SSDI

The IRS taxes your net income, which is what’s left after you subtract business expenses from gross earnings. SSA, however, evaluates your work activity, not just income. Even low net income can raise concerns if your hours or duties are considered “substantial.”

Example:

- You earn $18,000 from self-employment and deduct $6,000 in expenses.

- The IRS taxes the remaining $12,000.

- SSA may still count your full effort as significant, risking benefit loss.

If you over-deduct, SSA may flag you for doing too much work. If you underreport, the IRS may issue a tax notice. Accurate tracking and reporting help you stay compliant with both agencies and avoid penalties or benefit issues.

Why Social Security Disability Taxes Confuse Many People

Many people don’t expect SSDI to be taxable until work income or a spouse’s earnings push them over IRS limits. Even when you’re following the rules, the tax impact can be surprising.

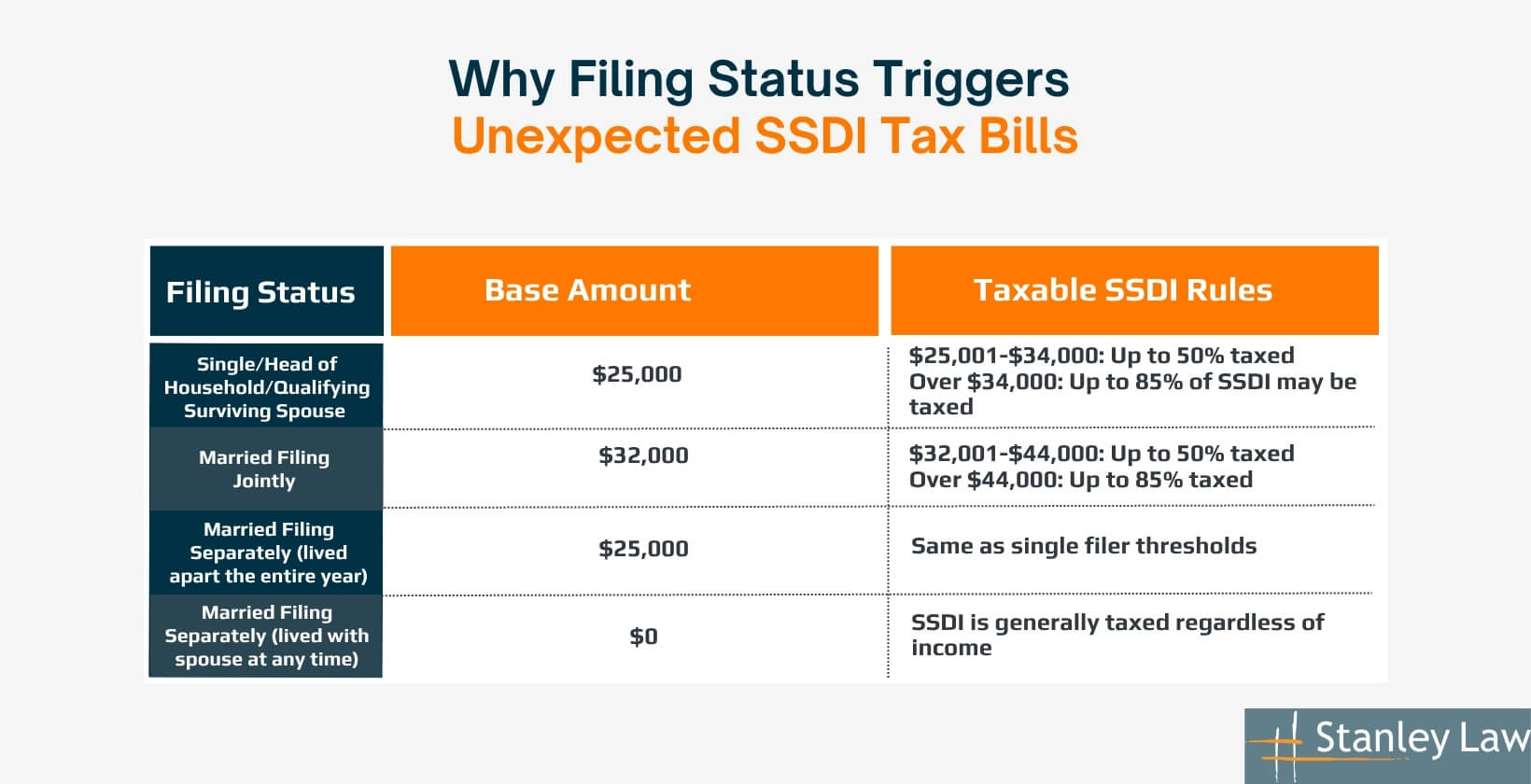

Why Filing Status Triggers Unexpected SSDI Tax Bills

Your tax liability for SSDI is directly affected by your filing status. Even if you don’t earn much yourself, a spouse’s income can push your combined income above IRS thresholds, resulting in partial or full SSDI taxation.

Here’s how the IRS applies taxation by filing status:

| Filing Status | Base Amount | Taxable SSDI Rules |

| Single/Head of Household/Qualifying Surviving Spouse | $25,000 | $25,001-$34,000: Up to 50% taxed Over $34,000: Up to 85% of SSDI may be taxed |

| Married Filing Jointly | $32,000 | $32,001-$44,000: Up to 50% taxed Over $44,000: Up to 85% taxed |

| Married Filing Separately (lived apart the entire year) | $25,000 | Same as single filer thresholds |

| Married Filing Separately (lived with spouse at any time) | $0 | SSDI is generally taxed regardless of income |

Why Tax Rules Don’t Adjust for Disability Automatically

SSDI benefits don’t include automatic federal tax withholding, which means you might owe taxes when you file your return. This often surprises recipients who spent their full benefit without planning for taxes.

If you’re working part-time, receiving back pay, or filing jointly, your combined income can trigger SSDI taxation.

To avoid unexpected tax bills, you can submit Form W-4V to request voluntary tax withholding from your SSDI payments.

Do You Need to File Taxes If You Only Receive SSDI or SSI?

If SSDI or SSI is your only income, filing a tax return is not always required, but there are situations where it’s still beneficial.

Optional Filing Scenarios and When They Offer Benefits

Even if you’re not legally required to file taxes, these situations make filing worthwhile:

- Earned Income Tax Credit (EITC): If you worked even briefly, you may qualify for a refund worth up to $7,000, depending on your income.

- Refund Recovery: Filing helps you claim withheld taxes or recover stimulus checks.

- Proof of Income: A tax return can support applications for housing, healthcare, or legal programs that require financial documentation.

Filing a simple return can give you access to benefits and protections, even when it’s not mandatory.

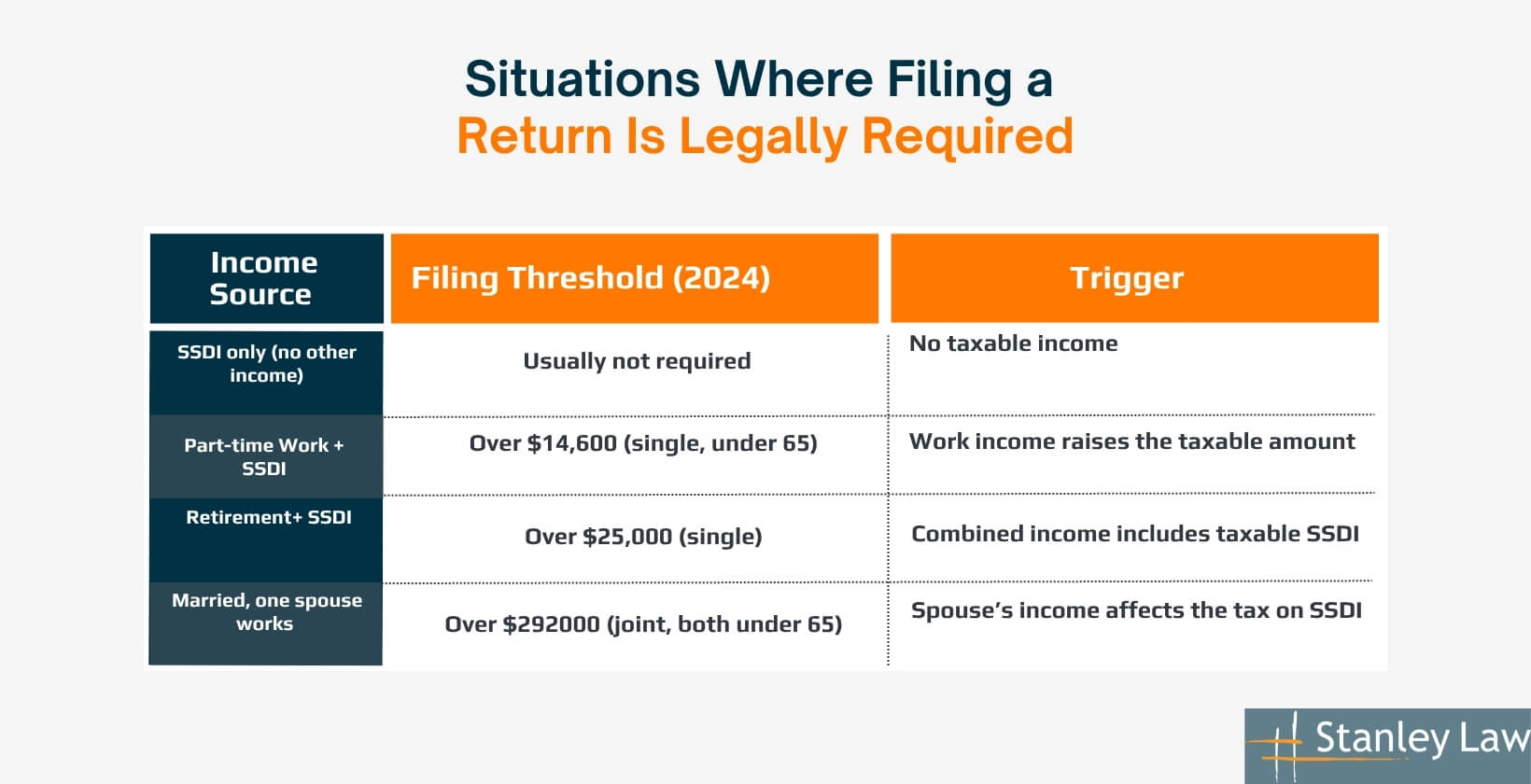

Situations Where Filing a Return Is Legally Required

You must file a tax return if your income exceeds IRS thresholds, even if you’re receiving SSDI. This includes income from work, retirement, or a spouse.

| Income Source | Filing Threshold (2024) | Trigger |

| SSDI only (no other income) | Usually not required | No taxable income |

| Part-time Work + SSDI | Over $14,600 (single, under 65) | Work income raises the taxable amount |

| Retirement+ SSDI | Over $25,000 (single) | Combined income includes taxable SSDI |

| Married, one spouse works | Over $292000 (joint, both under 65) | Spouse’s income affects the tax on SSDI |

If you exceed the filing threshold and don’t file, the IRS can charge penalties, apply interest, and withhold future refunds.

Do States Tax Social Security Disability Benefits?

Federal SSDI tax rules are consistent, but state tax laws vary. Some states fully exempt SSDI, while others may tax it based on income or residency.

States That Do Not Tax SSDI or SSI

These states do not tax Social Security Disability (SSDI) or Supplemental Security Income (SSI) either because they have no state income tax or they fully exempt Social Security benefits:

- Alaska

- California

- Florida

- Illinois

- Michigan

- Nevada

- New Hampshire (only taxes interest/dividends)

- New York

- Pennsylvania

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

If you move from one of these states to one that taxes SSDI, your monthly benefit will be reduced. Knowing your state’s tax laws protects your income.

Available State-Level Tax Credits and Exemptions for Disabled Individuals

Several states offer tax benefits to residents with disabilities, including property tax exemptions, rebates, and income tax exclusions. These programs depend on your income, age, or disability status.

Examples of State-Level Tax Benefits:

- California: Property tax exemption for totally disabled veterans. SSDI and SSI are fully exempt from income tax.

- New York: Income-based exemptions for senior or disabled homeowners. Additional relief for low-income renters with disabilities.

- Texas: Property tax freeze for disabled homeowners in school districts. No state income tax on SSDI.

- Pennsylvania: Property tax and rent rebate program for low-income seniors and disabled individuals.

- Illinois: Homestead exemption for disabled persons, offering property tax relief.

When to Consult a Social Security Disability Lawyer About Tax Issues

Tax issues tied to SSDI, like back pay, part-time work, or IRS notices, can cause serious financial stress. Consulting with an experienced New York SSDI claims lawyer helps clarify your situation and prevent costly mistakes.

Handling Unexpected SSDI Tax Bills with Legal Support

A surprise IRS bill related to SSDI is more common than you think. These often result from misreported back pay, incorrect SSA-1099 entries, or a spouse’s income raising your taxable amount.

A legal review identifies errors, fixes incorrect filings, and prevents future issues. Legal support helps protect your SSDI benefits and keeps your tax records accurate.

When Employment, Marriage, or Back Pay Complicate Tax Obligations

Work income, marriage, or lump-sum SSDI back pay often lead to surprise tax problems even when you’ve filed carefully. These changes increase your combined income or affect filing status, which may trigger unexpected IRS bills.

4 Common SSDI Tax Complications Stanley Law Offices Help With:

- Working While on SSDI: We review your income and explain how it affects your taxes and benefit eligibility.

- Marriage or Separation: We help calculate your combined income and check whether your filing status is raising your tax liability.

- Receiving Lump-Sum Back Pay: We allocate back pay across the correct tax years and amend past returns if needed.

- Surprise IRS Notices: We review your SSA-1099 and income records to identify and fix tax issues before penalties apply.

At Stanley Law Offices, our SSDI lawyers have handled hundreds of these cases and focus on resolving the issue before it becomes costly.

Need Help With Your SSDI Tax Case? Contact Stanley Law Offices

Struggling with an SSDI tax issue like a confusing SSA-1099, IRS notice, or income from part-time work? We resolve the most common Social Security tax problems quickly and accurately.

At Stanley Law Offices, we explain your options, correct reporting errors, and help protect your SSDI income. Consultations are free, and you pay nothing unless we win your case.

Speak with a New York Social Security Disability Lawyer who understands your situation and knows how to help you move forward. Call us at 800-608-3333.