Work credits are how the Social Security Administration tracks your eligibility for disability benefits. You earn them by working in jobs covered by Social Security and paying into the system through payroll taxes. If you happen to live in New York and can no longer work due to a serious medical condition, these credits will play a key role in your case in terms of determining your eligibility for Social Security Disability Insurance (SSDI).

The required work credits depend on your age and how recently you worked. For example, most New Yorkers over 31 years of age need at least 20 credits earned in the past 10 years. These guidelines help NY Social Security administrators evaluate whether your work history supports your claim.

At Stanley Law Offices, we help you understand how your work credits affect your SSDI application. If you are unsure whether you qualify or do not know how many credits you have earned, our team is here to guide you and pin down the critical information needed so that you can move forward with confidence.

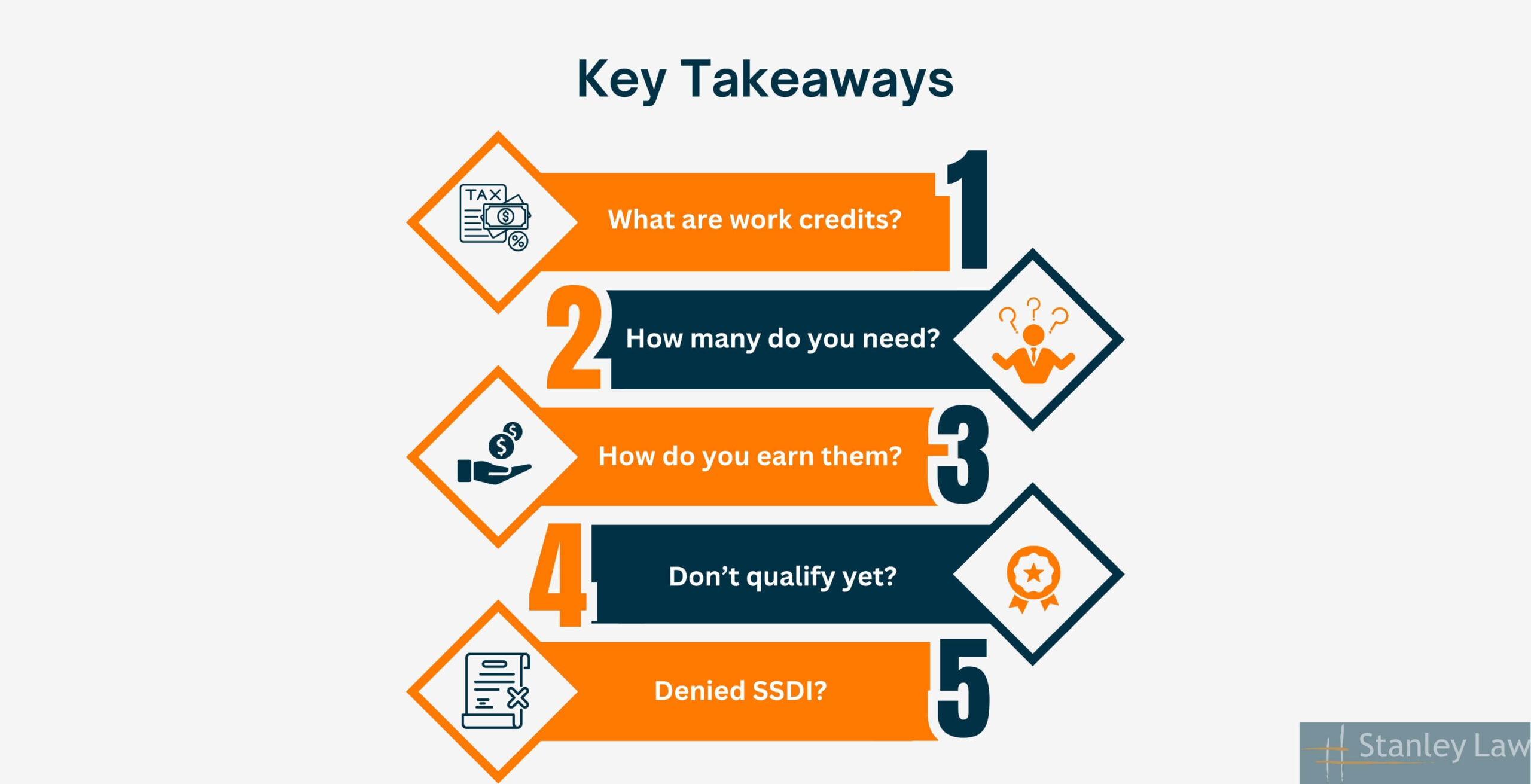

Key Takeaways From the Blog

- What are work credits? Proof you worked at jobs covered by Social Security and paid taxes.

- How many do you need? Most Empire State residents over age 31 need to have accumulated at least 20 credits in the last 10 years; younger and blind workers may need fewer.

- How do you earn them? In 2025, earn 1 credit per $1,810, up to 4 per year.

- Don’t qualify yet? Keep working and paying taxes to build credit.

- Denied SSDI? You can reapply, correct errors, or explore SSI.

How Do You Earn Work Credits?

Work credits are earned through taxable work covered by Social Security. Whether you are employed by a company or self-employed, your contributions through payroll or self-employment taxes help build your eligibility for benefits like SSDI. If you have worked and paid into the system, chances are that you have already started earning credits.

What Counts as Work for Earning Credits?

To earn work credits, your job must be considered covered employment, meaning it involves paying Social Security taxes. This includes most traditional jobs where taxes are withheld from your paycheck, as well as self-employment where you report income and pay self-employment tax.

You can earn credits through:

- Full-time or part-time jobs with reported wages.

- Freelance or contract work with documented income.

- Self-employment if taxes are properly filed and paid.

Unpaid roles, off-the-books jobs, or income not reported to the IRS do not count. Only officially taxed income contributes to your Social Security record and work credit history. For example, many people ask, “Is SSDI income taxable?” The answer depends on your total income and filing status. Understanding what counts as taxable income, including work that earns you credits, can help you better plan for how benefits may be taxed later.

Annual Earnings Thresholds (2024 and Recent Years)

Work credits are tied to your annual earnings, and the amount needed to earn a credit adjusts yearly. In 2024, you earn one work credit for every $1,730 in covered income; for every $6,920 earned or more, you will receive the maximum four credits for the year.

These thresholds increase over time with national wage trends. For 2025, one credit will require $1,810 in earnings, with $7,240 needed to earn all four credits. Keeping track of these changes is important, as they directly impact your path to qualifying for SSDI benefits.

Maximum Number of Credits Per Year

You earn a maximum of four work credits per year, even if your income exceeds the required threshold. In 2024, earning $6,920 qualifies you for all four credits.

Additional income will not increase your annual work credits. The Social Security Administration uses this rule to measure long-term work history, not short-term income spikes.

Track your yearly earnings to ensure you meet the credit cap for SSDI eligibility.

How Many Work Credits Do You Need to Qualify for SSDI?

To qualify for Social Security Disability Insurance (SSDI), you must have earned enough work credits through jobs covered by Social Security. Most New York residents need 40 credits, with 20 earned in the 10 years before their disability began. However, younger workers in NY may qualify with fewer. The exact number depends on your age and work history, with special rules for certain cases.

General Requirements (20 Credits in Last 10 Years)

If you’re over age 31, the Social Security Administration requires you to have earned at least 20 work credits in the 10 years leading up to your disability to qualify for SSDI. This shows you have been recently and consistently engaged in covered work.

In 2025, you earn one credit for every $1,810 in covered income, with a maximum of four credits per year. To meet the 20-credit threshold, most workers need about five years of steady, covered employment. These credits help SSA evaluate your work history and determine eligibility for benefits.

Rules for Workers Over Age 31

Workers who become disabled after age 31 must have earned at least 20 work credits within the 10 years immediately before their disability began. This requirement shows that you maintained recent, steady employment in jobs that qualify for Social Security.

For example, a 45-year-old would need qualifying earnings between the ages 35 and 45. A 50-year-old follows the same rule. What is most important is that your work credits fall within that 10-year window leading up to your disability, not just that you have them.

Special Rules for Younger Workers

If you’re under age 31, the Social Security Administration uses a different formula to determine your SSDI eligibility, requiring fewer work credits than older applicants. The general rule is that you must have worked at least half the time between the age 21 and the age when you became disabled.

Here’s how it breaks down:

- Under age 24: You need 6 work credits earned in the 3 years before your disability.

- Ages 24–30: You must have credits equal to half the years between age 21 and the onset of disability.

Examples:

- John, age 26, needs 10 work credits (5 years since turning 21 × 2 credits per year).

- Maria, age 23, needs just 6 credits from the past 3 years.

These special rules ensure that younger workers are not excluded from SSDI simply because they have not had time to build a long work history.

Exceptions for Blind Workers or Survivors

The Social Security Administration offers special provisions for blind workers, allowing them to qualify for SSDI with fewer or older work credits. Unlike most applicants, blind individuals will not be held to the same “recent work” requirement and may use credits earned further back in their work history.

Survivor benefits are also available to certain family members of a deceased worker, such as a spouse, child, or dependent parent, if the worker had earned enough credits. The exact number depends on the worker’s age at the time of death, but the claim still relies on the same Social Security credit system. These exceptions ensure that workers and their families are protected, even in difficult circumstances.

How to Check Your SSDI Work Credits Online

Tracking and recording your SSDI work credits is essential and simple to do. You can check your current credits and earnings history anytime by logging into your Social Security account at ssa.gov/myaccount.

Once logged in:

- Go to the “Earnings Record” or “Estimated Benefits” section

- Review your annual earnings and total work credits

- Compare them with your tax documents (W-2s, 1099s, or Schedule SE)

If you notice any missing or incorrect earnings, contact the SSA right away using supporting documents like pay stubs or tax returns. Keeping your record accurate with periodic checks ensures that you will not face delays when time comes to apply for SSDI benefits.

Work Credits for Self-Employed and Gig Workers

Self-employed individuals, freelancers, and gig workers earn SSDI work credits by reporting income and paying self-employment (SE) tax. This requires filing IRS Form 1040 along with Schedule C and Schedule SE each year. Without these, your credits will likely not be counted.

Only earned income qualifies. This includes payments for services like ridesharing, freelance writing, or selling products. Passive income such as earnings from investments, rental properties, or dividends does not count toward SSDI work credits.

The SSA pulls your earnings data directly from IRS records, so accurate filing is critical to protect your eligibility.

What If You Don’t Qualify for SSDI Work Credits?

If you don’t have enough work credits, you cannot receive SSDI, but other disability support programs are available. Supplemental Security Income (SSI) and state-run benefits may provide help based on income, resources, or residency. Don’t automatically assume you are out of luck, because each program has different rules. If you are uncertain about which path to take, speak with a disability attorney at Stanley Law Offices to review your options.

SSDI Alternatives (SSI, State Disability Programs)

SSDI eligibility requires work credits, but SSI is based on income and resources, not work history. If you do not qualify for SSDI due to insufficient credits, you may be eligible for SSI or state disability programs.

Here’s how SSI and SSDI compare for New York residents:

| Program | Eligibility Basis | Work Credit Needed | Health Insurance Provided | Notes for New York Residents |

| SSDI | Disability + work history | Yes (Credits required) | Medicare (after 24 months) | Must have recent Social Security-covered work. |

| SSI | Disability + low-income resources | No | Medicaid (immediate) | SSI recipients in NY are automatically enrolled in Medicaid. |

Can You Still Apply?

Yes, you can still apply for SSDI even if you are unsure about your work credit history. The Social Security Administration evaluates two main criteria: your medical condition and your work credits.

First, SSA reviews your medical eligibility. Then it checks your work credits to confirm you meet the non-medical requirement for SSDI. Even without knowing your exact credit total, you should still start the application at ssa.gov.

Building Up Work Credits Over Time

You earn Social Security work credits by working in a job covered by Social Security and paying the required taxes. In 2025, one credit is earned for every $1,810 in covered earnings, up to a maximum of four credits per year.

For example, earning at least $7,240 in 2025 qualifies you for all four credits that year. These credits stay on your record permanently.

If you do not qualify for SSDI now, you can continue working to accumulate enough credits and apply once you meet the eligibility threshold. For more information, read our detailed blog on What to do if your SSDI claim is denied?

Confused About SSDI Credits? Free Legal Help Available

SSDI work credit rules can be difficult to understand, especially if your job history includes gaps, self-employment, or freelance work. These credits determine whether you qualify for SSDI benefits.

At Stanley Law Offices, we help New York residents review their work credit records, fix SSA errors, and understand their SSDI options. If you have questions about your eligibility, contact us today for a free consultation.

FAQs About SSDI Work Credits

How many years of work are 40 credits for Social Security?

You can earn up to 4 work credits per year, so 40 credits equal about 10 years of work in jobs covered by Social Security. Note that these years do not have to be consecutive, but they must meet the earnings thresholds set by the SSA during those years.

What happens if you don’t work 35 years for Social Security?

Social Security calculates retirement benefits based on your 35 highest-earning years. If you worked fewer than 35 years, the SSA adds zero-income years, which lowers your monthly benefit.

What is the minimum Social Security benefit if you never worked?

If you never earned Social Security work credits, you are not eligible for SSDI or retirement benefits. However, SSI is available to low-income individuals without a work history.

Can a person who never worked collect Social Security?

Yes, someone who never worked may receive benefits as a spouse or survivor of a covered worker. SSI may also be available if they meet income and disability criteria.

What is the minimum Social Security benefit with 40 credits?

The minimum Social Security benefit with 40 work credits depends on your lifetime earnings. In 2024, the average minimum benefit was about $1,000 per month. SSA adjusts this annually based on earnings history.

What is the minimum Social Security benefit with 40 credits at age 62?

If you claim Social Security at age 62, your benefit is permanently reduced. With 40 credits and low earnings, you may receive less than $1,000 monthly. SSA calculates the amount using average indexed monthly earnings.

What to Do After Reading About SSDI Work Credits

Check your SSA earnings record to confirm you’ve earned enough Social Security work credits for SSDI. Log in at ssa.gov and review your reported income for gaps or missing data.

If you’ve been denied SSI due to insufficient work credits, speak with a Social Security disability lawyer. At Stanley Law Offices, we help New York residents correct SSA records, file appeals, and understand their next steps.