A contingency fee (also called a contingent fee) is a payment arrangement between a client and a lawyer where the attorney is paid only if the client wins or settles the case. Instead of charging hourly or upfront fees, the lawyer’s payment is a percentage of the money recovered for the client. In many New York personal injury cases, the fee is often around one-third (33.3%), and some court rule schedules use tiered percentages that include a 40% bracket on an early portion of the recovery.

If there is no financial recovery, you usually do not owe an attorney fee, which is why people call it “no win, no fee.” Case costs may still be your responsibility depending on what your written agreement says.

In New York, these cases are typically filed in the Supreme Court of the State of New York, and the rules require a written explanation of how the fee will be calculated, what expenses may be deducted, and whether the percentage changes for settlement, trial, or appeal.

For many people across Upstate New York, this structure makes it possible to hire counsel while dealing with medical bills and time away from work. It also aligns incentives, since the lawyer’s fee depends on a financial recovery.

Key Takeaways From the Blog

- A contingency fee means you do not pay attorney fees upfront.

- The lawyer is paid only if there is a financial recovery through a settlement or verdict.

- In many personal injury cases, fees are commonly structured around one third (33⅓ %), and court rules may allow a tiered schedule on the recovery amount.

- The agreement must be in writing and should clearly explain the fee structure and how case costs (disbursements) are handled.

- If there is no recovery, you generally do not owe an attorney fee, but case costs depend on the written agreement.

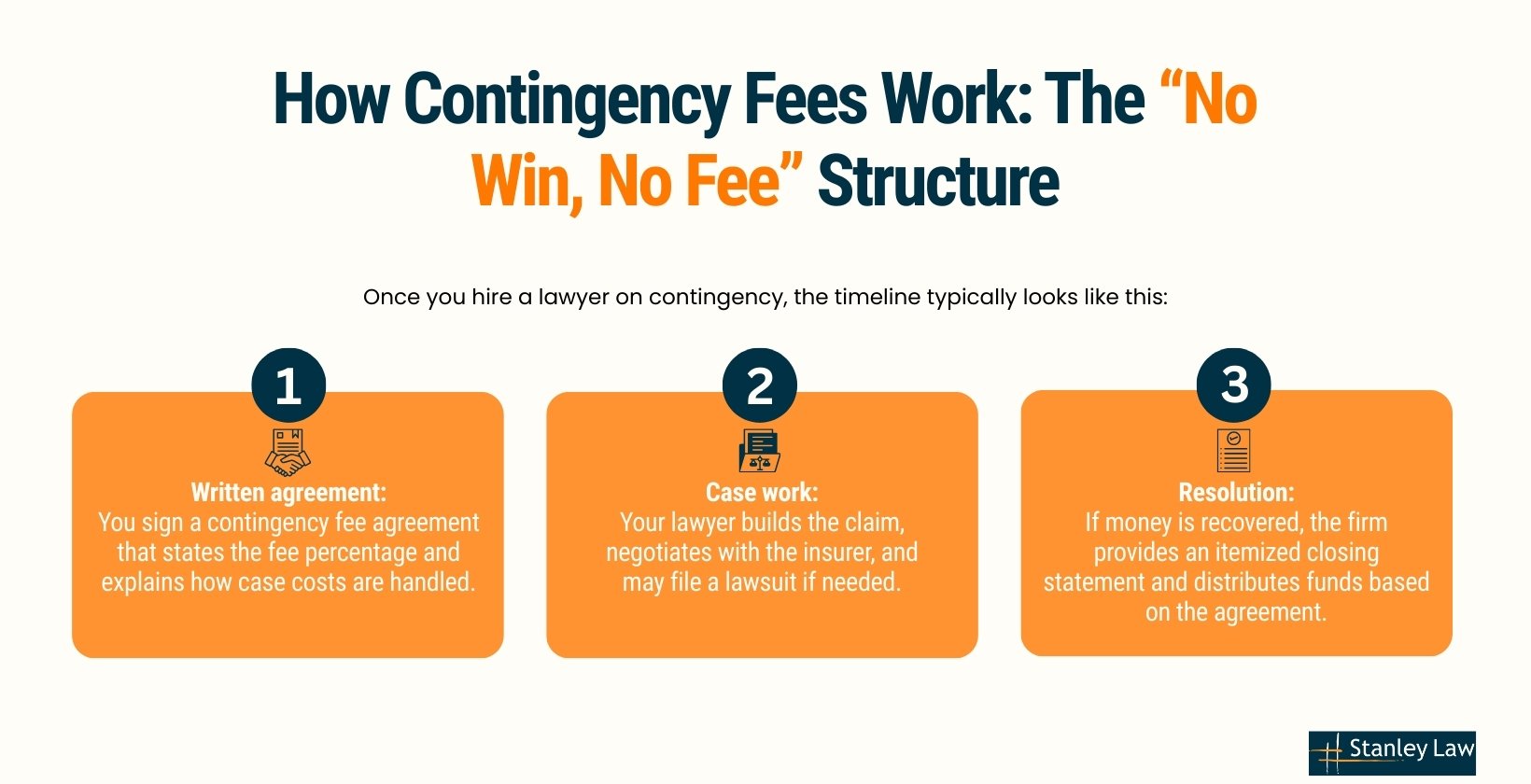

How Contingency Fees Work: The “No Win, No Fee” Structure

Once you hire a lawyer on contingency, the timeline typically looks like this:

- Written agreement: You sign a contingency fee agreement that states the fee percentage and explains how case costs are handled.

- Case work: Your lawyer builds the claim, negotiates with the insurer, and may file a lawsuit if needed.

- Resolution: If money is recovered, the firm provides an itemized closing statement and distributes funds based on the agreement.

Where the Settlement Money Goes and How It Is Paid Out

When a case resolves, settlement funds are typically deposited into a client trust account before any checks are issued. In New York, you may see this described as an IOLA account. It is a standard way to protect client funds during distribution.

Before the money is distributed, you should receive a written closing statement showing how the recovery was divided, including the total recovery amount, the attorney fee, itemized disbursements, and the amount paid to you.

Example:

- Settlement: $300,000

- Attorney fee (one third, if that is the agreed structure): $100,000

- Disbursements: $15,000

- Client amount before liens or reimbursements: $185,000

Attorney Fees vs. Case Costs (Disbursements)

People often hear “no attorney fee upfront” and assume everything is free. In a contingency fee case, it helps to separate two categories: attorney fees and case costs (also called disbursements).

Attorney Fees

Attorney fees are what you pay for legal work, like investigating the claim, negotiating with the insurer, and preparing for litigation if needed. In a contingency fee arrangement, the attorney fee is paid from a settlement or verdict, not out of your pocket while the case is ongoing.

Case Costs (Disbursements)

Case costs are out-of-pocket expenses paid to third parties to move the case forward. Common examples include:

- Court Filing Fees: Paid to the County Clerk.

- Medical Records: Fees paid to hospitals for your charts.

- Expert Witnesses: Doctors or accident reconstructionists required to prove your case.

- Deposition Costs: Stenographers and transcripts.

If there is no recovery, you usually do not owe an attorney fee. Whether you may still owe some case costs depends on the written agreement. Before you sign, ask the lawyer to show you exactly how expenses are handled.

How Are Contingency Fee Percentages Calculated in NY?

In New York, contingency fees are regulated. The percentage has to be reasonable, and in many personal injury cases it follows court rule fee schedules. Those schedules can be set up two ways: a tiered schedule that starts higher on the first portion of the recovery and drops as the recovery increases, or a one third option if the written retainer provides for it.

Standard Personal Injury Cases

Many people hear “one third (33⅓%)” because it is common in practice, but New York court rules also allow a tiered schedule in which the early portion of the recovery can include a 40% bracket, then decreases as the amount recovered increases. The fee is computed using the rules’ definition of the “net sum recovered,” which is not always the same as “what is left after every bill is paid.”

Medical Malpractice (Statutory Sliding Scale)

Medical, dental, and podiatric malpractice cases follow a statutory fee cap under New York Judiciary Law § 474 a. The fee cannot exceed this sliding scale:

- 30% of the first $250,000 recovered

- 25% of the next $250,000

- 20% of the next $500,000

- 15% of the next $250,000

- 10% of any amount over $1,250,000

Infant’s Compromise ( Cases Involving Minors)

If a child under 18 is injured, the settlement must be approved through an infant’s compromise. As part of that process, the court reviews attorney fees and expenses and may reduce the fee to protect the child’s recovery.

Types of Cases That Commonly Use Contingency Fee Agreements in NY

Contingency fees are most common in civil cases where the goal is to recover money damages. In New York, contingency fees are generally not allowed in criminal defense or divorce matters.

Common examples include:

- Motor vehicle crashes: Car, truck, motorcycle, pedestrian, and bicycle accidents.

- Slip, trip, and fall injuries: Unsafe property conditions, snow and ice hazards, poor maintenance.

- Construction site injuries: Claims under New York Labor Law § 200, 240(1), and 241(6).

- Medical malpractice: Medical, dental, and podiatric negligence.

- Wrongful death: Fatal accident claims brought by the estate and surviving family members.

- Dangerous or defective products: Product liability and failure to warn claims.

- Nursing home neglect or abuse: Injury and preventable harm in long-term care settings.

- Railroad worker injuries (FELA): Claims under the Federal Employers’ Liability Act (when applicable).

Contingency Fees vs. Hourly, Flat Fee and Retainers

Lawyers in New York do not charge the same way for every case. The billing method usually depends on the type of legal problem and whether the case is about recovering money damages.

| Fee Type | When You Pay | Who Carries Most of the Risk | Predictability | Where It Is Common |

|---|---|---|---|---|

| Contingency | Paid from the recovery at the end of the case | Lawyer (no attorney fee without a recovery) | Medium (depends on outcome and timing) | Personal injury, wrongful death, medical malpractice |

| Hourly | Ongoing invoices as work is done | Client (pays regardless of result) | Low to medium (depends on time spent) | Business disputes, ongoing legal advice, many civil matters |

| Flat Fee | One set price for defined service | Client | High (price is agreed upfront) | Simple document work, uncontested matters, routine filings |

| Retainer (Upfront Deposit) | Paid at the start, then applied to future work | Usually client | Varies | Often used with hourly billing in non injury matters |

Note: A retainer is not a separate billing method by itself. It is usually a deposit that is applied to hourly work or a flat fee, depending on the agreement.

Pros, Cons, and Common Misconceptions About Contingency Fees

Contingency fees can make it easier to bring a claim, but they also come with benefits and limits. The key is understanding what you gain, what you give up, and what “no win, no fee” does and does not mean.

Pros

- No upfront attorney fees: You can move forward without paying hourly bills as the case is ongoing.

- Shared risk: If there is no recovery, you usually do not owe an attorney fee for the lawyer’s time.

- Aligned incentives: The lawyer’s fee depends on recovering compensation, so both sides are motivated to document the full value of the case.

Cons

- A percentage of the recovery: If a case resolves quickly, a contingency fee may be more than what hourly billing would have been.

- Not available in every type of case: Contingency fees are generally not used in criminal defense or divorce matters in New York.

- Case costs may still apply: Disbursements can still be your responsibility depending on the written agreement, even if there is no recovery.

Common Misconceptions

Myth: All lawyers work on contingency.

Fact: Many matters use hourly or flat fees. Contingency is most common in injury cases.

Myth: “No win” means you never pay anything.

Fact: You usually do not owe an attorney fee without a recovery, but case costs can be handled differently depending on the agreement.

Myth: A contingency fee gives the lawyer full control.

Fact: You decide whether to accept a settlement. The lawyer handles strategy and court filings.

Myth: Percentages are unlimited in New York.

Fact: Fees are regulated, and medical malpractice fees follow a statutory sliding scale.

Myth: A contingency fee guarantees a big payout.

Fact: Results depend on liability, proof, insurance coverage, and damages.

Who Pays Case Costs and Litigation Expenses?

In many contingency fee cases, the law firm advances case costs while the claim is being pursued. If there is a recovery, those costs are typically reimbursed from the settlement or verdict. If there is no recovery, whether you still owe some costs depends on the written agreement.

Common case costs can include:

- court filing and service fees

- medical records and reports

- deposition transcripts and court reporter charges

- expert review or expert witness fees when needed

- investigation costs

What to Review Before Signing a Contingency Fee Agreement

Before you sign, make sure these points are clear:

- Whether the fee percentage changes if the case goes to trial or appeal.

- When you will receive a written closing statement and when funds are typically distributed.

- How liens and reimbursements are handled and who negotiates them.

- What decisions you control, especially whether to accept a settlement.

- What happens if there is a fee dispute and what options you have.

Legal Rules Governing Contingency Fees in New Yor

New York has specific rules that limit and structure contingency fees, especially in personal injury and medical malpractice cases.

Key laws and rules include:

- 22 NYCRR 1200.1.5 (Rule 1.5, Fees): Requires a written contingency fee agreement, clear disclosure of expenses the client may be responsible for, and a written closing statement at the end of the matter showing how the client’s share was calculated.

- 22 NYCRR 691.20 (Appellate Division fee schedule, Second Department): Sets out a “reasonable fee” schedule used in certain personal injury matters, including a tiered structure that can start with a 40% bracket on an early portion of the recovery and then decrease as the recovery increases. Other Departments have similar schedules.

- Judiciary Law § 474 a (Medical, dental, and podiatric malpractice): Caps contingency fees in medical malpractice cases using a statutory sliding scale tied to the amount recovered.

- 22 NYCRR Part 1215 (Letters of engagement): Requires engagement letters in many matters and explains when they are required and when exceptions apply. It is separate from contingency fee rules but often part of the intake paperwork.

- 22 NYCRR Part 137 (Fee dispute resolution): Provides a process for resolving certain attorney client fee disputes through arbitration.

What to Remember Before You Sign

A contingency fee can make it possible to pursue a serious injury claim without paying hourly legal bills upfront. The most important step is knowing what the written agreement says about the percentage, case costs, and how the final distribution will be shown when the case ends.

If you want help reviewing a contingency fee agreement or you have questions about how it applies to a New York injury claim, Stanley Law Offices offers a free case review. Contact us now.

FAQs About Contingency Fees in New York

Are Contingency Fees Calculated Before or After Medical Liens?

It depends. Contingency fees may be calculated before or after medical liens based on the written agreement. New York law requires full disclosure of how liens affect your net recovery.

Are Contingency Fees Negotiable?

Sometimes. Many firms use a common structure in injury cases, but clients can ask questions and request clarification before signing. The most important part is understanding exactly what the percentage applies to, whether it changes for trial or appeal, and how costs are handled.

How Long Does It Take to Resolve a Contingency Fee Case in New York?

It varies. Contingency fee cases in New York may settle within months or take years, depending on case complexity, insurance negotiations, and court delays. Your lawyer can estimate a timeline based on your specific facts.

Is My Settlement Taxable?

Often, compensation for physical injuries or physical sickness is treated differently for tax purposes than interest or punitive damages. If your settlement includes interest, punitive damages, or other non-injury components, taxes can come into play. For anything beyond the basics, a tax professional can advise you based on how the settlement is structured.

Can I Switch Lawyers if I Signed a Contingency Agreement?

Yes. You can change lawyers, but the prior lawyer may claim a lien for the reasonable value of the work performed. This is typically handled between lawyers during the transition and is addressed when the case resolves.