Social Security Disability Insurance (SSDI) is a federal disability benefits program run by the Social Security Administration (SSA). It pays monthly benefits to workers who can’t work because of a serious medical condition expected to last at least 12 months or result in death.

SSDI is funded through FICA payroll taxes. If you have enough work credits and your condition keeps you from performing substantial gainful activity (SGA) before retirement age, SSDI may help replace part of your lost income. When you reach full retirement age, SSDI automatically converts to Social Security retirement benefits under the same earnings record.

Key Takeaways From the Blog

- SSDI is a federal disability insurance benefit based on your work history and Social Security credits, not financial need.

- To qualify, you must be insured based on work credits and meet SSA’s disability rules.

- Date Last Insured (DLI) can decide the case, even when your condition is serious.

- Medical records and consistency across forms matter because SSA focuses on functional limits and credibility, not just a diagnosis.

- If denied, you can appeal, but deadlines are strict and missing them can set your claim back.

What Is the Difference Between SSDI and SSI?

SSDI and SSI are both run by the Social Security Administration, and both can help when a disability keeps you from working. The key difference is how you qualify: SSDI is based on your work history and credits, while SSI is based on financial need and can also help some people age 65 or older.

Here’s a quick side-by-side comparison (SSDI vs SSI):

| Topic | SSDI (Social Security Disability Insurance) | SSI (Supplemental Security Income) |

|---|---|---|

| What it is | Disability benefits for workers who paid into Social Security | Needs-based payments for people who are disabled, blind, or age 65+ with limited income and resources |

| What you must prove | A qualifying disability under SSA rules | The same disability rules (or age 65+ without disability), plus financial need |

| Work history required | Yes. You generally need enough work credits | No. Work credits are not required |

| Based on income or assets | Not based on household income or assets, but work activity and earnings can affect eligibility | Yes. Strict income and resource limits apply |

| Monthly payment amount | Based on your earnings record | Based on the federal benefit rate, reduced by countable income |

| Health coverage | Medicare is available after a waiting period for most people | Medicaid coverage is typically available for people who qualify for SSI, including in New York. |

| Family benefits | Possible auxiliary benefits for certain spouses and children | No dependent benefits based on your record |

| Where payments come from | Social Security payroll tax system | General federal tax revenues |

| Best fit for | Workers with sufficient work history who become disabled | People with limited income and resources, including seniors aged 65+ |

Can You Receive Both SSI and SSDI?

Yes, some people can receive both at the same time. This is called “concurrent benefits.” It usually happens when your SSDI payment is low enough that you also meet the income and asset rules for Supplemental Security Income. In that situation, SSI can help bring your total monthly support up to the SSI limit, and it may also provide immediate Medicaid eligibility in many states.

Are you still confused about whether you can receive ssdi and ssi at the same time? Read our detailed blog on Can You Get SSDI and SSI Benefits Together?

SSDI Eligibility Requirements

To qualify for SSDI benefits, you must meet two sets of rules. First, you need enough work history to be insured. Second, you must meet Social Security’s definition of disability.

Work History and Social Security Credits

Eligibility is tied to your work record and the Social Security credits you earned. To be “insured,” you must have worked long enough to build enough credits. Many adults need up to 40 total credits, with about 20 earned in the 10 years before disability begins, depending on age at onset.

Many people call this the “5-year rule” because it usually works out to about five years of work in the last ten. If you stopped working a long time ago, you might have plenty of lifetime credits but still not meet the recent work test.

Younger workers may qualify with fewer credits because the required work history is shorter.

Date Last Insured (DLI) and Why It Matters

Even if you earned enough credits in the past, SSDI coverage can expire. Social Security assigns a Date Last Insured (DLI), which is the last date you still met disability insured status. For most Title II SSDI claims, Social Security generally needs to find that your disability began on or before your DLI, so medical evidence should document your limitations during that period. This issue often comes up after long gaps in employment or years of off-the-books work.

SSA’s Definition of Disability (5-Step Test)

The SSA uses a 5-step process to decide whether you meet its definition of disability :

- Are you working? Earning over $1,690 per month in 2026 ($2,830 if blind) generally counts as substantial gainful activity (SGA) and may disqualify you.

- Is your condition severe? It must significantly limit basic work activities.

- Is it in the Blue Book? Some conditions qualify; if they meet a Blue Book listing.

- Can you do your past work? SSA evaluates whether you can still perform your prior jobs.

- Can you do any other work? SSA looks at your RFC and applies vocational rules, including the medical vocational guidelines (often called the grid rules), along with your age, education, and job skills.

What If You Do Not Meet a Blue Book Listing?

If you do not meet a listing, SSA usually moves to a medical vocational review. SSA focuses on your Residual Functional Capacity (RFC), meaning what you can still do despite symptoms and limitations. Then SSA compares your RFC to your past work and to other work in the national economy, using factors like age, education, and job skills.

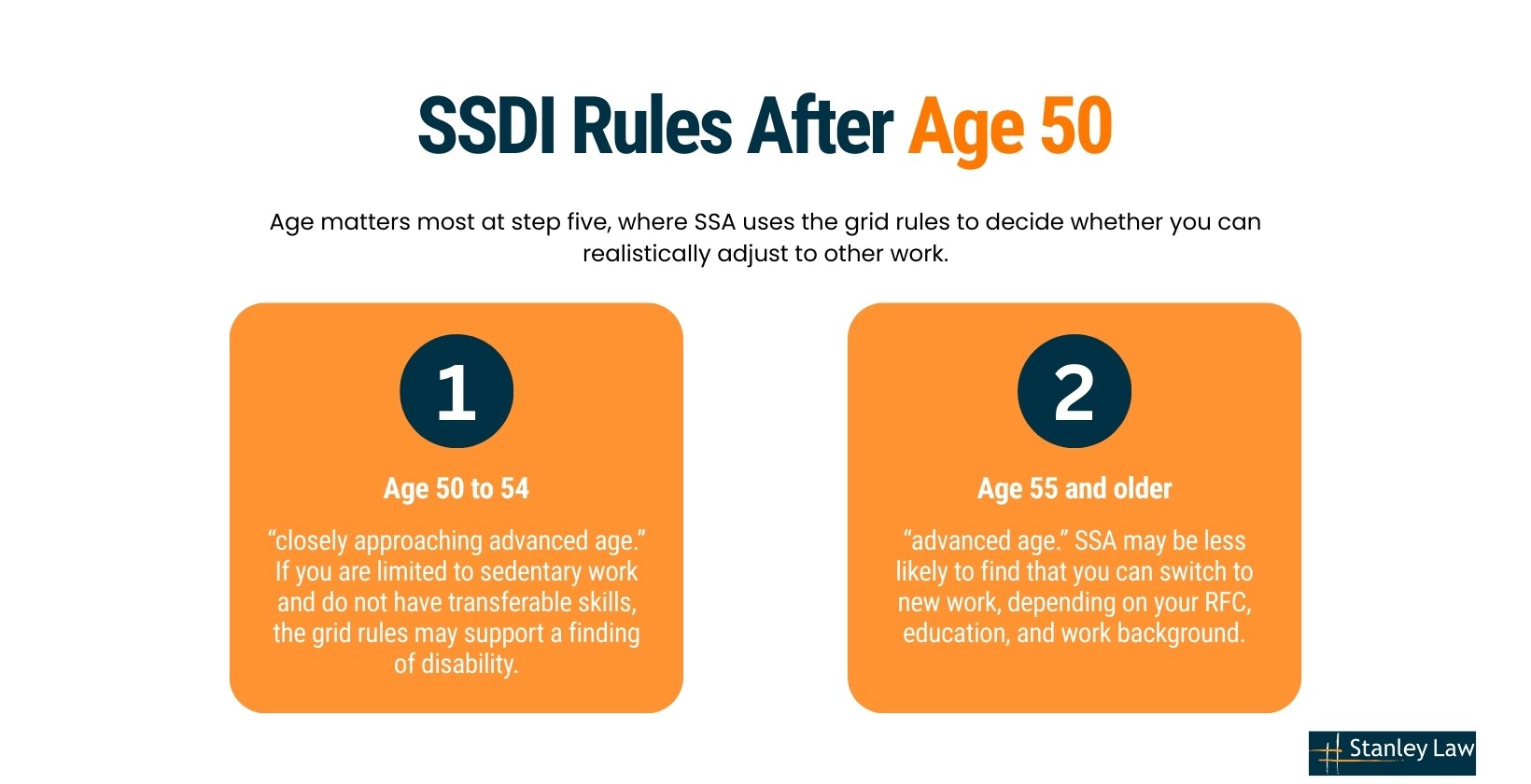

SSDI Rules After Age 50

Age matters most at step five, where SSA uses the grid rules to decide whether you can realistically adjust to other work.

- Age 50 to 54: “closely approaching advanced age.” If you are limited to sedentary work and do not have transferable skills, the grid rules may support a finding of disability.

- Age 55 and older: “advanced age.” SSA may be less likely to find that you can switch to new work, depending on your RFC, education, and work background.

This is not automatic approval. It is a different way SSA weighs vocational realities when the medical evidence shows meaningful limits.

Medical Conditions That Qualify

A diagnosis by itself does not guarantee SSDI approval. Social Security looks at whether your condition meets a Blue Book listing or whether your symptoms and limits keep you from working full-time. Common examples include certain cancers, serious spine or musculoskeletal disorders, advanced heart conditions, and severe mental health disorders such as schizophrenia or major depression.

Who Does NOT Qualify

SSDI is not available for:

- Short-term conditions that are expected to improve in under 12 months.

- Claims without consistent medical documentation.

- Applicants earning above SGA.

Workers who do not meet the insured status rules.

How to Apply for SSDI (Step-by-Step)

Applying for SSDI takes time and a lot of paperwork. The best way to avoid delays is to start with the right records and keep your answers consistent from the beginning.

Step 1: Do a quick pre-check

Before you start the application, confirm two things: you are still insured for SSDI based on your work credits, and your condition is expected to keep you from working for at least 12 months.

Step 2: Gather your records

Missing records are a common reason applications slow down. Try to collect:

- Medical records (office notes, hospital visits, test results, imaging).

- A detailed work history, including job duties and physical demands.

- Your Social Security number and a government-issued ID.

Step 3: File the application

You can apply in one of three ways:

- Online through SSA’s website (SSA.gov)

- By phone at 1-800-772-1213

- In person at your local New York SSA office (Syracuse, Binghamton, Utica, etc.)

Step 3A: Complete the extra forms that DDS (Disability Determination Services) relies on

Most people are asked to complete additional reports that help Disability Determination Services review both your medical limits and your work history, such as:

- function reports about day-to-day activities and limitations

- work history reports describing what your past jobs required

- medical release forms so DDS can request records directly

Tip: keep your answers consistent across forms and medical records. If one form says you can stand 30 minutes and another suggests hours, it can hurt your credibility.

Step 4: Review, submit, and save proof

Before you hit submit:

- Double-check that every required section is complete.

- Keep a copy of what you submitted.

- Save or print your confirmation page.

Step 5: Wait for the DDS review and respond quickly

In New York, Disability Determination Services evaluates your medical evidence and how your condition affects your ability to work. This is where complete and consistent documentation matters most.

DDS may schedule a consultative exam with a doctor they choose if they need more information. If you miss that appointment without a good reason, SSA may deny the claim.

Step 6: Track your claim status

While you wait, you can:

- Check your status through your My Social Security account.

- Call SSA for updates.

SSDI Application to Decision and Payment Timeline

Wait times depend on your records, whether SSA schedules an exam, and how busy the system is, but here’s the usual range:

- Initial decision: SSA says it usually takes 6 to 8 months.

- If denied and appeal: The reconsideration and hearing stages can add additional months, and the wait often depends on the hearing office. SSA publishes hearing-level processing time reports you can review for trends.

- When payments start if approved: There is generally a five-month waiting period, and the first payment is paid the sixth full month after the date SSA finds your disability began.

What SSDI Benefits Do You Get?

If your SSDI claim is approved, your main benefit is a monthly payment based on your earnings record. Depending on your situation, you may also qualify for Medicare and, in some cases, payments for certain family members.

Monthly SSDI Payments (2026 Updates)

SSDI payments are based on your past earnings, calculated using your Average Indexed Monthly Earnings (AIME). Because SSDI is federal, the payment formula is the same in New York and every other state.

- Estimated average SSDI payment (2026): $1,630 per month

- Substantial Gainful Activity (SGA) guideline (2026): $1,690 per month ($2,830 if blind)

- Maximum monthly benefit at full retirement age (2026): $4,152

- Cost-of-Living Adjustment(COLA): 2.8%

When SSDI Payments Start, Back Pay, and Retroactive Benefits

SSDI does not start paying immediately. In most cases, SSA requires a five-month waiting period after the disability onset date SSA establishes, so entitlement begins in the sixth full month.

If you’re approved, you may receive past due benefits:

- Back pay: Benefits owed from the first month you were entitled to be paid (after the waiting period) through the date your claim is approved.

- Retroactive benefits: Benefits for months before you applied, which can be paid up to 12 months before your application date if you were disabled earlier and meet the rules.

Medicare Eligibility

Most people become eligible for Medicare after 24 months of SSDI benefit entitlement. Enrollment is automatic for many recipients.

Medicare generally includes:

- Part A (hospital insurance)

- Part B (medical insurance), which usually has a monthly premium

Some people qualify sooner. For example, SSA has special timing rules for ALS( Amyotrophic Lateral Sclerosis ), and different rules apply for End Stage Renal Disease (ESRD).

Benefits for Spouses and Children

In some cases, SSA may pay benefits to certain family members based on your SSDI record, including:

- a spouse age 62 or older, or a spouse caring for a child under 16

- children under 18, or under 19 if still in school

- an adult child whose disability began before age 22

These payments are limited by SSA’s family maximum rules, and SSDI eligibility requirements depend on the family member’s relationship and circumstances.

Workers’ Compensation and Public Disability Benefits Can Reduce SSDI

If you receive workers’ compensation or certain other public disability benefits, SSA may reduce SSDI so the combined total does not exceed 80% of your average current earnings before disability. This is called the workers’ compensation offset, and it applies to SSDI, not workers’ comp.

If you have an open workers’ comp claim or settlement, flag it early so SSA can calculate the offset correctly.

Understanding how SSDI works is only half the picture – knowing how to build your SSDI case correctly from the start is what actually determines your outcome. Attorney Shannon Doan breaks it down in the webinar below.

In this webinar, Attorney Shannon Doan walks through 10 practical steps to strengthen an SSDI case, from setting up your My Social Security account and staying on top of medical records, to responding to SSA requests promptly and maintaining consistent treatment. If you’re preparing to file or want to avoid the most common reasons claims get denied, these tips apply directly to how Social Security evaluates every application.

What to Do If You’re Denied SSDI

A denial is common, especially at the first decision. Social Security has an appeal process, and you do not have to start over if you file on time and submit the right evidence.

SSDI Appeals Process (4 Stages)

If you disagree with a decision, you can appeal. Most disability cases follow these levels:

- Reconsideration: A different reviewer looks at your file and any new evidence you submit.

- Administrative Law Judge (ALJ) hearing: If reconsideration is denied, you can request a hearing. In New York, hearings are scheduled through a Social Security hearing office, and the format may be in person, by video, or by phone, depending on how SSA sets the calendar.

- Appeals Council review: The Appeals Council reviews whether the ALJ made a legal or procedural error.

- Federal court: If the Appeals Council denies review or issues an unfavorable decision, you can file a civil action in U.S. District Court.

Appeals Deadlines

In most cases, you have 60 days to appeal after you receive a decision. Social Security generally assumes you received the notice 5 days after the date on the letter, unless you can show you received it later. That is why you will sometimes hear people describe it as “about 65 days from the notice date,” but the safest approach is to file as early as possible.

If you miss the deadline, SSA may still accept the appeal if you show good cause, such as serious illness or a situation that prevented timely filing.

SSDI Hearing Preparation Tips

If you request an ALJ hearing, focus on three things:

- Updated medical records that show ongoing treatment and current limits.

- A simple timeline of symptoms, treatment, and work attempts.

- A clear explanation of why you cannot return to full-time work, using specific examples from daily life and past job duties.

Common Reasons for SSDI Denial

A denial does not always mean your condition is not serious. In many cases, the issue is evidence, work rules, or paperwork. Here are the most common reasons:

- Medical evidence is thin or inconsistent, or the records do not match the limitations reported.

- Income is over SGA, which in 2026 is $1,690 per month ($2,830 if blind).

- Insured status issues, including not enough recent work credits, or a Date Last Insured problem.

Application-level problems, like vague work history details or missing forms that DDS relies on.

Ready to Talk Through an SSDI Denial or Appeal?

If you’re unsure what your SSDI denial means or why Social Security says evidence is missing, our attorneys will review your denial notice with you, explain your options, and help you prepare a clear, complete appeal for SSA.

At Stanley Law Offices, we guide clients throughout Upstate New York, including Syracuse, Watertown, Binghamton, and Utica, in responding to SSA notices, managing appeal requirements, and meeting critical deadlines.

Call 1-800-608-3333 or request a free SSDI case review today via our contact form.

Frequently Asked Questions About SSDI

Do I Need a Lawyer to Apply for SSDI in New York?

You do not legally need a lawyer to apply for Social Security Disability Insurance (SSDI) in New York, as you can file on your own.

However, because the process is complicated, with over 60% of initial applications often denied, hiring a New York social security lawyer is highly advantageous to handle deadlines, medical evidence, and appeals.

What is a Consultative Exam for SSDI?

A consultative exam for SSDI is a medical exam that Social Security schedules when your records do not answer key questions. Social Security pays for the consultative exam, and missing the exam can lead to a denial.

Is SSDI Income Taxable?

SSDI benefits are taxable only if your combined income is high enough.

- Below $25,000 (single) or $32,000 (joint): not taxable

- $25,000–$34,000 (single) or $32,000–$44,000 (joint): up to 50% taxable

- Above those ranges: up to 85% taxable

No more than 85% of SSDI benefits are ever taxed.

Can You Work While Receiving SSDI?

Yes. You can work during a Trial Work Period. In 2026, a month usually counts if you earn over $1,210. After that, earnings over $1,690 per month in 2026 can count as SGA ($2,830 if blind) and may affect benefits.

How Does Social Security Decide the Disability Onset Date?

Social Security determines the disability onset date by identifying the earliest date you met SSA’s medical definition of disability and all non-medical eligibility requirements. To do this, SSA reviews medical evidence, work history, your alleged onset date, and the overall timeline of your condition to establish the official disability onset date.