Are personal injury settlements taxable in New York? In most cases, the answer is no, compensation for physical injuries or illnesses is not considered taxable income by either the IRS or New York State. Whether awarded through a lawsuit or a private settlement, these payments are treated as non-taxable compensatory damages.

However, some parts of a settlement are taxable. These include punitive damages, interest, and payments for emotional distress unrelated to physical injury. Lost wages and previously deducted medical expenses may also trigger tax liability depending on how they are classified.

Knowing which portions of your settlement are taxable helps you protect your recovery and avoid surprises at tax time, especially when guided by an experienced New York personal injury lawyer.

Taxable vs. Non-Taxable Parts of a Personal Injury Settlement

| Settlement Component | Tax Status |

|---|---|

| Physical injury compensation | Non-taxable |

| Pain & suffering (from injury) | Non-taxable |

| Emotional distress (from injury) | Non-taxable |

| Emotional distress (no physical injury) | Taxable |

| Lost wages (from physical injury) | Non-taxable |

| Lost wages (employment lawsuit) | Taxable |

| Reimbursed medical expenses (if deducted) | Taxable |

| Punitive damages | Taxable |

| Interest on the settlement or court award | Taxable |

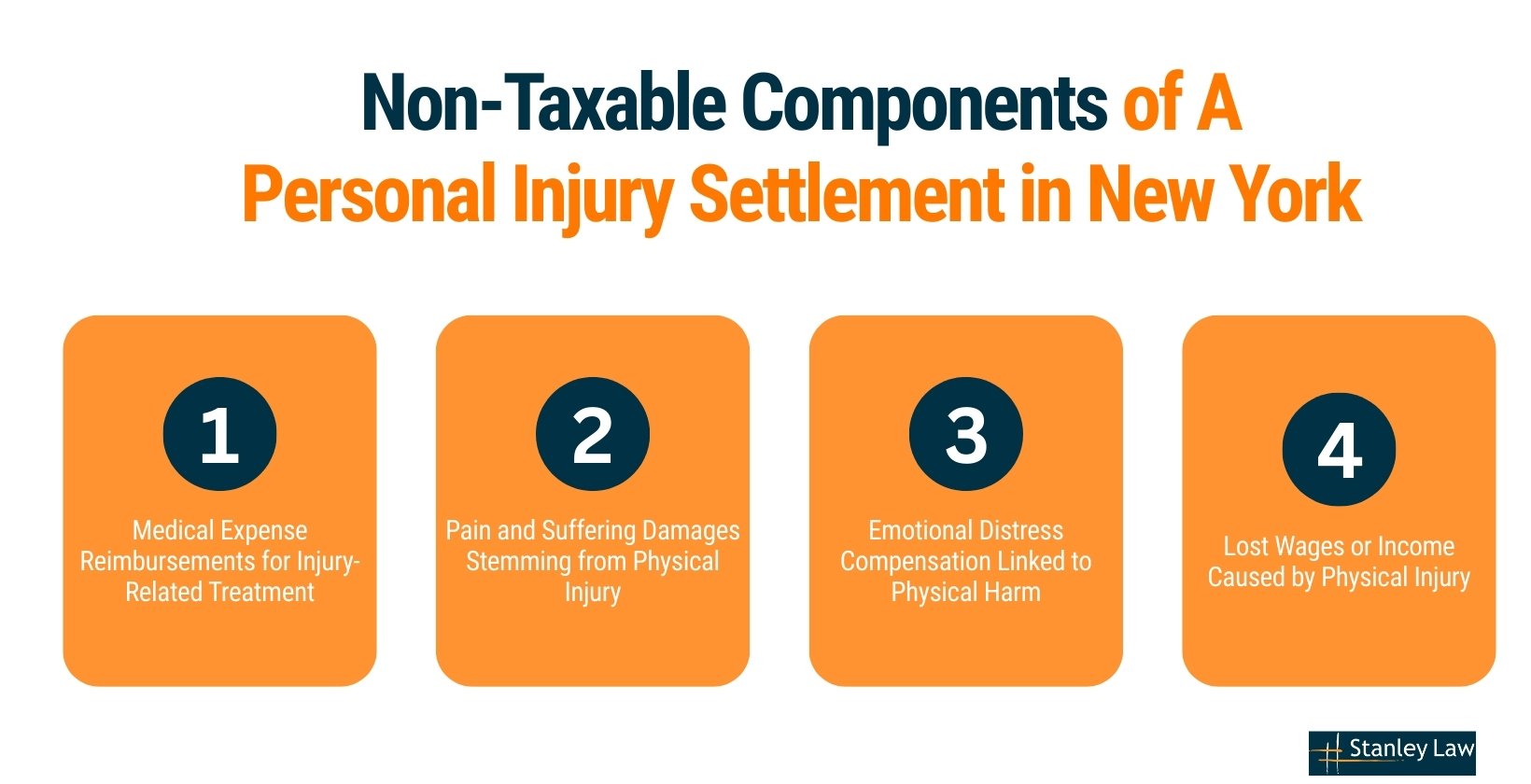

Non-Taxable Components of A Personal Injury Settlement in New York

Certain parts of a personal injury settlement, like payments for medical costs, pain, or income loss from an injury, are not taxed in New York. These are classified as compensatory damages and fully excluded from taxable income.

Medical Expense Reimbursements for Injury-Related Treatment

Compensation received to cover medical expenses tied to a physical injury is non-taxable. This includes payment covering hospital stays, surgeries, doctor visits, prescriptions, and physical therapy services.

This tax exclusion applies only if those expenses were not previously deducted. If the same costs were claimed as deductions in past tax years, any later reimbursement becomes taxable income to prevent a double tax benefit.

Pain and Suffering Damages Stemming from Physical Injury

Pain and suffering damages linked to physical harm, such as chronic pain, permanent disability, or scarring, are tax-exempt. The IRS and New York classify these as compensatory and exclude them from income, even when paid in a lump-sum settlement.

Emotional Distress Compensation Linked to Physical Harm

Emotional distress compensation is non-taxable only if caused by physical injury. Mental health conditions such as PTSD, anxiety, or depression qualify when directly linked to an injury. Compensation for emotional harm unrelated to physical injury, such as workplace conflict or reputational damage is taxable.

Lost Wages or Income Caused by Physical Injury

Lost wages are tax-exempt only if directly caused by a physical injury. Income awarded for reasons unrelated to injury, such as discrimination or wrongful termination, is treated as taxable under IRS rules.

Taxable Parts of A Personal Injury Settlement in New York Under IRS and NY Law

While many personal injury settlements are tax-exempt, certain components are treated as taxable income under New York and federal law. These often relate to penalties, interest, or claims unrelated to physical harm. Knowing the difference can prevent costly mistakes when reporting your settlement.

Punitive Damages Awarded to Penalize the Defendant

Punitive damages are fully taxable because they are meant to punish the defendant, not to compensate for injury. Whether awarded by a jury or part of a settlement, these damages must be reported as income on IRS Form 1040.

Compensation for Emotional Distress Without Physical Injury

If a physical injury does not cause emotional distress, the compensation related to it is taxable. For example, damages awarded for anxiety due to workplace harassment or damage to reputation must be reported.

Reimbursements for medical treatment within that amount, like therapy or medication, may be excluded. But the emotional distress award itself remains subject to income tax under IRS rules.

Damages from Breach of Contract Claims

Settlement funds from breach of contract claims are generally taxable. Since these disputes don’t involve physical harm, the payments, such as for lost profits or delays, must be reported as income.

Interest Earned on Settlement or Court Judgment

Interest earned on a personal injury settlement, either before or after judgment, is taxable. It’s considered investment income, listed separately in IRS filings, and fully taxed since it’s not linked to physical harm.

Reimbursement of Previously Deducted Medical Expenses

If you deducted medical expenses in a previous year and later recover that amount through a settlement, the reimbursement becomes taxable. This prevents receiving a double benefit for the same expense.

Example: If you deducted $8,000 in medical bills from your taxes in 2023, and then recovered $8,000 in a 2025 settlement, that reimbursement must be reported as income in 2025.

Wages Awarded from Employment-Related Legal Claims

Wages from employment lawsuits, such as for wrongful termination or unpaid compensation, are fully taxable. Since they aren’t linked to physical injury, they’re treated as regular income.

Taxable wage settlements are usually reported on IRS Form W-2 or 1099-MISC, depending on how the employer issues the payment.

How Should a Personal Injury Settlement Be Structured to Reduce Taxes in New York?

Structure a personal injury settlement by clearly labeling each damage category and separating taxable from non-taxable components. Here are practical ways to reduce taxes through proper structuring:

- List damages separately to distinguish taxable from non-taxable components.

- Identify punitive damages clearly, as they are always taxable.

- Label emotional distress as injury-related to maintain its tax-exempt status.

- Separate post-judgment interest since it must be reported as income.

- Connect lost wages directly to physical injury to avoid classification as taxable earnings.

- Avoid vague terms like “general damages” that could lead to IRS scrutiny.

- Schedule payments strategically if you’re in a high-income year to lower your tax bracket impact.

How Can a Personal Injury Attorney Help You Reduce Tax on Your Settlement?

Personal injury attorneys help reduce your tax exposure by properly categorizing each part of your personal injury settlement. Our team ensures that compensation for physical injuries or related emotional distress stays tax-exempt, while taxable items such as interest or punitive damages are clearly separated. By using IRS-compliant language and aligning your agreement with both federal and New York tax laws, we help prevent misclassification and lower your audit risk.

Use these attorney-approved structuring tactics:

- Itemize damages clearly to avoid having the full settlement treated as income.

- Separate compensatory from punitive damages so only the latter is taxed.

- Label emotional distress properly, non-taxable if linked to physical injury.

- Break out post-judgment interest to keep interest from inflating the full amount.

- Use IRS-compliant language in your agreement to avoid misclassification.

At Stanley Law Offices, we guide clients through the tax side of settlements with clarity and care. By identifying tax-exempt components and organizing taxable ones correctly, we help protect your financial recovery and reduce the stress that often comes with legal paperwork.

Tax-Sensitive Case Results – Stanley Law Offices

| Case Type | Amount | Tax Strategy Used |

|---|---|---|

| Misdiagnosis – Permanent Blindness | $3.2 Million | Emotional distress and loss are classified as injury-based compensation. |

| Construction Fall – Herniated Disc | $750,000 | Medical costs and wage loss are tied directly to physical injury. |

| Falling Ice Injury – Head Trauma | $595,000 | Injury-related medical payout is excluded from taxable income. |

| Elevator Malfunction – Spinal Injury | $500,000 | Compensation structured to separate pain, suffering, and interest. |

The right legal strategy protects your settlement and maximizes your after-tax recovery.

FAQs on Personal Injury Settlements in NY

Do I Need to Report a Personal Injury Settlement to the IRS If It’s Non-Taxable?

No, you do not need to report a personal injury settlement to the IRS if it is non-taxable. The compensation must be for physical injuries or sickness and must not include interest or punitive damages.

Can You Structure a Personal Injury Settlement to Reduce Tax Exposure?

Yes, you can structure a personal injury settlement to reduce tax exposure. Attorneys use settlement language and damage breakdowns to ensure tax-exempt parts are preserved and taxable items, like interest or wages, are reported properly.

How Do I Know If a Portion of My Settlement Was for Punitive Damages?

To know if a portion of your settlement was for punitive damages, review the settlement breakdown. Punitive damages are listed separately and are always taxable under IRS rules, unlike compensation for physical harm.

Will Accepting a Lump Sum Settlement Affect My SSI or Other Government Benefits?

Yes, a lump sum personal injury settlement can affect SSI or other government benefits. To avoid losing eligibility, place funds in a special needs trust or use structured payouts that preserve qualification.

Can I Deduct Legal Fees Related to a Personal Injury Settlement on My Taxes?

Legal fees are not deductible if the settlement is tax-exempt. If your personal injury settlement includes taxable damages, a portion of the legal fees may be deducted based on the taxable amount.

How to Avoid Paying Taxes on a Lawsuit Settlement?

To avoid paying taxes on a lawsuit settlement, itemize damages clearly. Separate taxable and non-taxable parts, use IRS-compliant language, and classify emotional distress properly if it’s linked to physical injury.

Protect Your Settlement from Unnecessary Taxes with Legal Help from Stanley Law Offices

At Stanley Law Offices, we’ve observed that how a settlement is structured often matters more than its size when it comes to tax impact. Small differences in wording can shift the tax outcome significantly.

For those reviewing a settlement, exploring how similar cases were handled can offer a useful perspective before final decisions are made, and we’re always open to sharing what we’ve seen. Contact us.