Yes, it’s possible to receive both Social Security Disability Insurance (SSDI) and Supplemental Security Income (SSI) at the same time. This is called concurrent benefits, and it applies when your SSDI payment is below the federal SSI benefit limit and you meet SSI’s strict income and resource rules.

Are you wondering whether you qualify for both SSDI and SSI together? You’ll find clear answers below, including who meets the requirements, how payments are calculated and how the application process works through the SSA. Read on to find out if you’re eligible and how to take the next step.

What Are SSDI and SSI in Simple Terms?

Social Security Disability Insurance (SSDI) is a federal benefit program for people who have worked and paid into Social Security but can no longer work due to a qualifying disability. It is based on your prior work history and the amount you’ve contributed through payroll taxes (FICA). If approved, you will receive a monthly payment based on your earnings record.

Supplemental Security Income (SSI) is a needs-based program that helps individuals who are disabled, blind, or aged 65 and older and have limited income and resources. It does not require a work history. Instead, eligibility is determined based on strict financial limits.

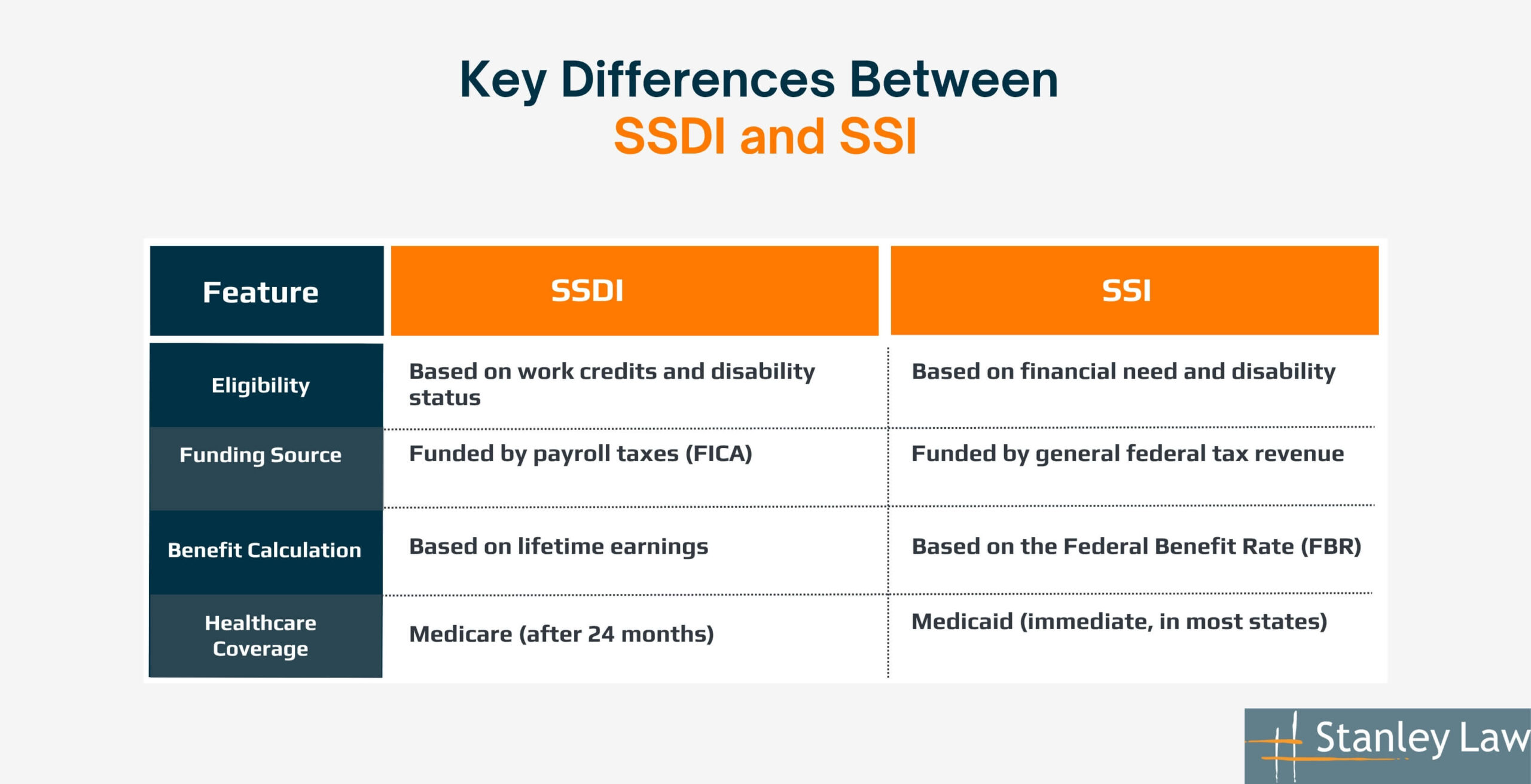

Key Differences Between SSDI and SSI

| Feature | SSDI | SSI |

| Eligibility | Based on work credits and disability status | Based on financial need and disability |

| Funding Source | Funded by payroll taxes (FICA) | Funded by general federal tax revenue |

| Benefit Calculation | Based on lifetime earnings | Based on the Federal Benefit Rate (FBR) |

| Healthcare Coverage | Medicare (after 24 months) | Medicaid (immediate, in most states) |

Can You Receive Both SSDI and SSI at the Same Time?

Yes, you can receive both SSDI and SSI simultaneously through a process called concurrent benefits. This happens when your SSDI payment is low enough that you still qualify for SSI under the 2025 limits.

The SSA uses SSI to supplement your SSDI up to the federal SSI benefit rate, which in 2025 is $1,015 per month for individuals. This ensures those with a limited earnings history receive sufficient financial support.

Concurrent SSDI and SSI Eligibility Requirements

- Receive SSDI below $1,015 per month (2025 FBR)

- Meet SSI income and asset limits (e.g., under $2,000 in countable assets for individuals)

- Apply and qualify separately for each program

- Be determined eligible by the SSA under both criteria

Eligibility Logic Flow

- If you have a qualifying disability and work history → you may receive SSDI.

- If your SSDI is below $1,015 and you meet financial limits → you may qualify for SSI.

- If both are true → you’re eligible for the concurrent benefit.

This combined benefit structure helps individuals whose SSDI alone doesn’t cover basic living expenses.

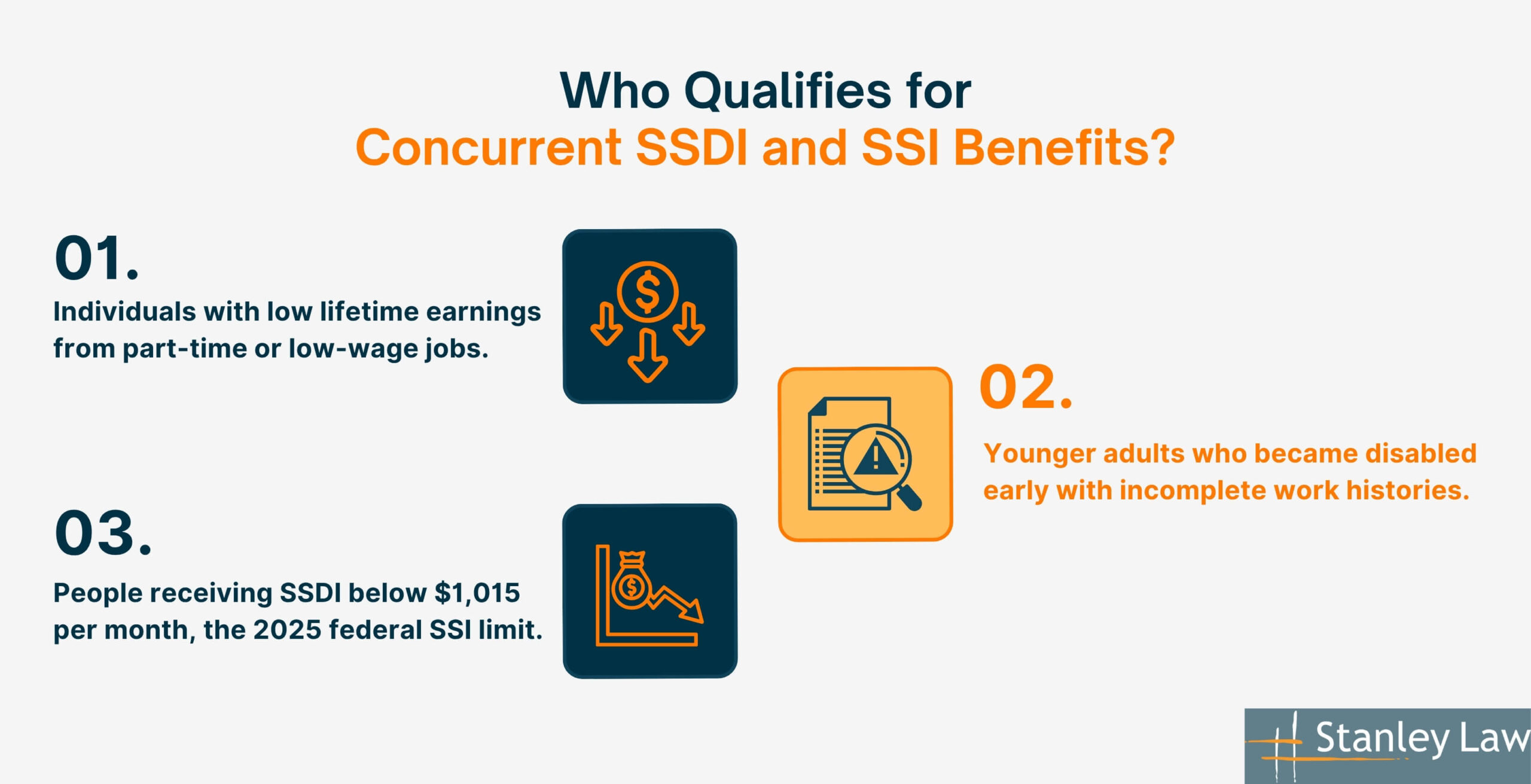

Who Qualifies for Concurrent SSDI and SSI Benefits?

Concurrent SSDI and SSI benefits are intended for individuals who qualify for both programs but receive low SSDI payments due to limited work history or earnings. These individuals often fall under SSI’s income limits and pass the asset test.

Common qualifying profiles

- Individuals with low lifetime earnings from part-time or low-wage jobs.

- Younger adults who became disabled early with incomplete work histories.

- People receiving SSDI below $1,015 per month, the 2025 federal SSI limit.

An Example:

Mary, age 42, receives $780 per month from SSDI due to her part-time work history. She has $1,500 in countable resources. Since she falls below the $1,015 per month FBR and under the $2,000 resource limit, she qualifies for a $235 per month SSI supplement, bringing her total benefit to $1,015 per month.

How Do Payments Work If You Qualify for Both?

SSDI and SSI payments don’t combine – they coordinate. SSI acts as a supplement, not an addition. If your SSDI is below the 2025 Federal Benefit Rate (FBR) of $1,015, SSI fills the gap.

Step-by-Step Example

- Your SSDI benefit: $800 per month

- 2025 SSI FBR: $1,015 per month

- SSI supplement: $215 per month

- Total monthly benefit: $800 + $215 = $1,015

SSI + SSDI Interaction Scenarios

| SSDI Amount | SSI Supplement | Total Monthly Payment |

| $520 | $495 | $1,015 |

| $800 | $215 | $1,015 |

| $1,020 | $0 | $950 (SSI ineligible) |

If your SSDI exceeds $1,015 per month, you typically won’t qualify for SSI unless your state provides additional supplements that raise the income cap.

These state-level SSI supplements vary and may increase your eligibility. Check with your local SSA office or legal representative for details.

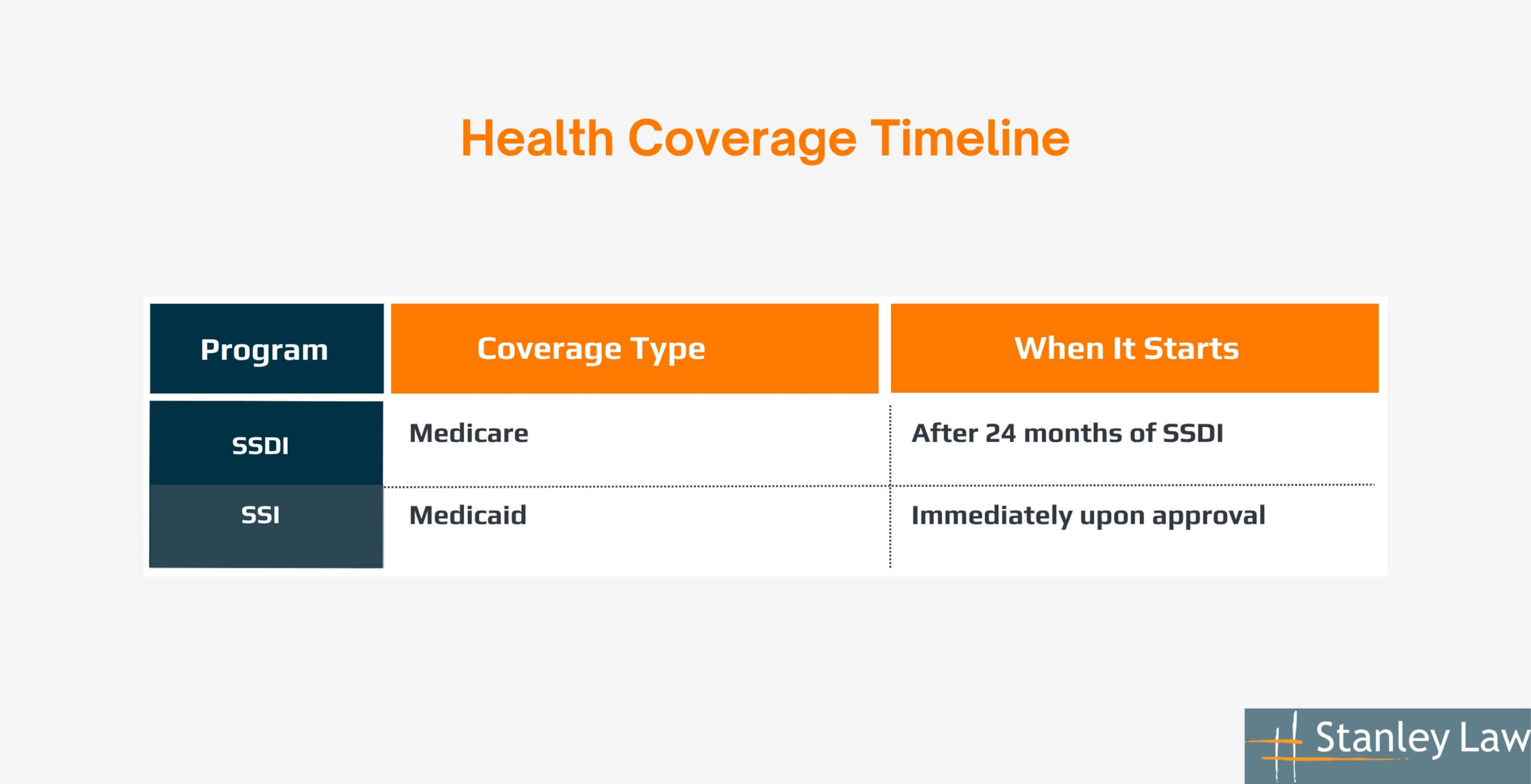

How Do Concurrent Benefits Affect Medicaid and Medicare?

Concurrent SSDI and SSI beneficiaries receive both Medicare and Medicaid, but eligibility timing differs.

- Medicare: Starts 24 months after SSDI approval

- Medicaid: Starts immediately upon SSI approval (in most states)

Health Coverage Timeline

| Program | Coverage Type | When It Starts |

| SSDI | Medicare | After 24 months of SSDI |

| SSI | Medicaid | Immediately upon approval |

This dual eligibility helps cover expenses Medicare may not, such as premiums and out-of-pocket costs. You may also qualify for Medicare Savings Programs, which use Medicaid funds to help pay Medicare-related expenses.

These benefits ensure better access to affordable, comprehensive healthcare for those who qualify for concurrent SSDI and SSI.

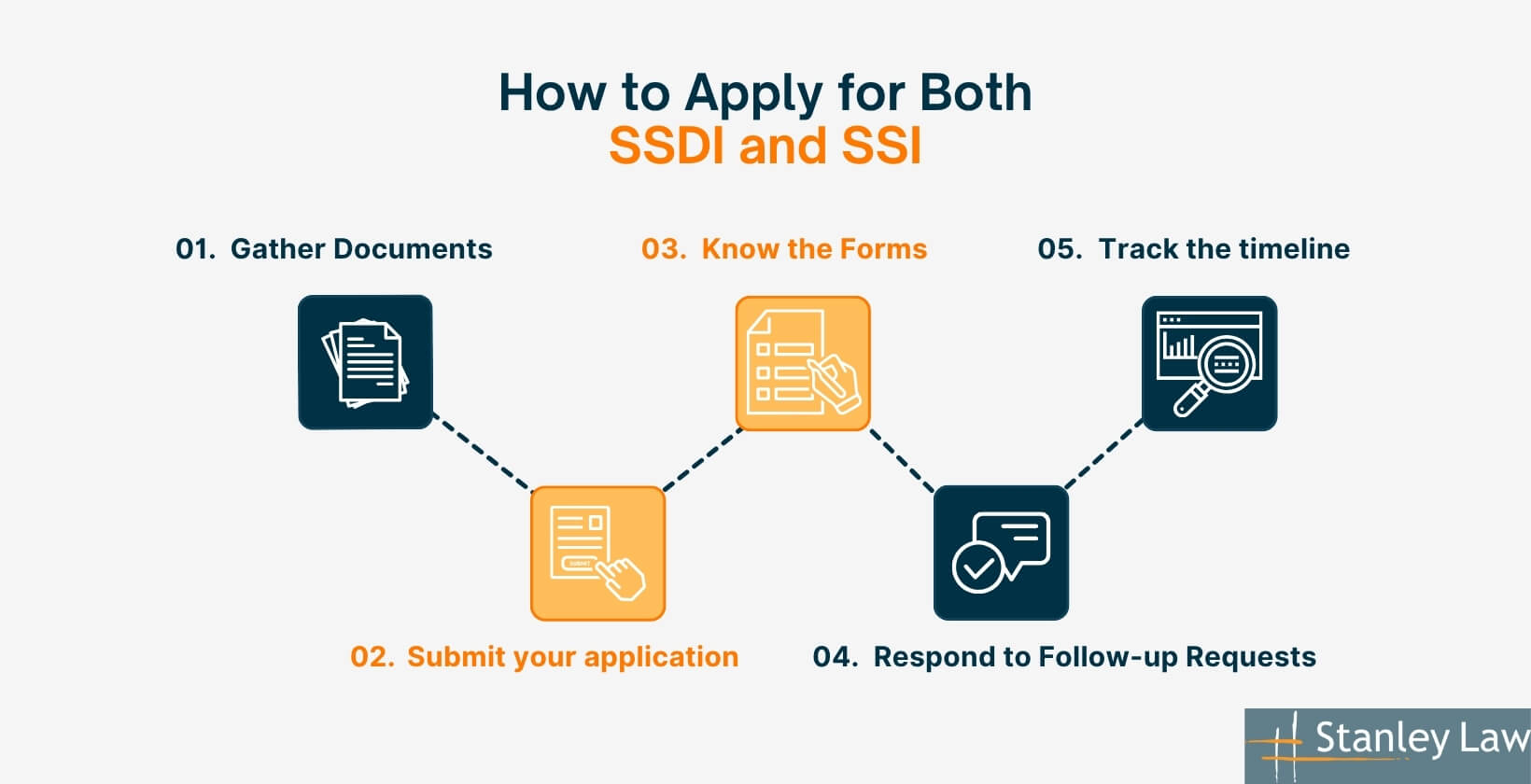

How to Apply for Both SSDI and SSI

A single application through the Social Security Administration (SSA) is all it takes. During the review process, the SSA will automatically assess your eligibility for both SSDI and SSI benefits.

Follow these 5 steps:

- Gather Documents: Prepare medical history, work records, proof of income, and bank statements.

- Submit your application: File online at SSA.gov, by phone, or at a local SSA office.

- Know the Forms:

- SSA-16 → SSDI

- SSA-8000 → SSI

- Respond to Follow-up Requests: You may be asked to attend an interview or submit additional documents.

- Track the timeline

- Initial decision: 3–6 months

- If denied: You must appeal within 60 days

Tip: Many applicants benefit from working with a NY Social Security disability attorney, especially when appealing denials or handling complex cases.

Need Help with Your SSDI or SSI Claim? Talk to Stanley Law Offices

Navigating SSDI and SSI eligibility is complex, especially when applying for both programs. That’s where Stanley Law Offices can help.

Our attorneys specialize in disability claims, including concurrent SSDI and SSI benefits, and provide trusted guidance throughout the process.

Get the support you need!

Contact Stanley Law Offices today for a free consultation.