After a car accident in New York, most medical bills and lost wages are covered by the state’s No-Fault insurance system – up to $50,000. But if your injuries go beyond that, and you’re left dealing with long-term pain, surgeries, or time off work, No-Fault alone may not be enough.

To sue the other driver for additional damages like pain and suffering, your injury must meet what’s called the “serious injury threshold” under New York Insurance Law §5102(d). This threshold is the legal test that decides whether you can step outside the No-Fault system and pursue a personal injury lawsuit.

If you’re unsure whether your injury qualifies, we can explain how New York law defines serious injuries and what it takes to bring a valid lawsuit.

What Is the Serious Injury Threshold in New York?

The “serious injury threshold” is a legal standard under New York Insurance Law that determines whether an injured person can step outside the No-Fault system and file a personal injury lawsuit.

This threshold comes into play after Basic Economic Loss (BEL), typically capped at $50,000, has been exhausted. To proceed with a lawsuit, your injury must fall into one of several categories defined by law, such as a fracture, disfigurement, or long-term loss of function.

The purpose of this rule is to limit lawsuits to cases involving substantial, medically supported harm, not everyday soreness or short-term injuries.

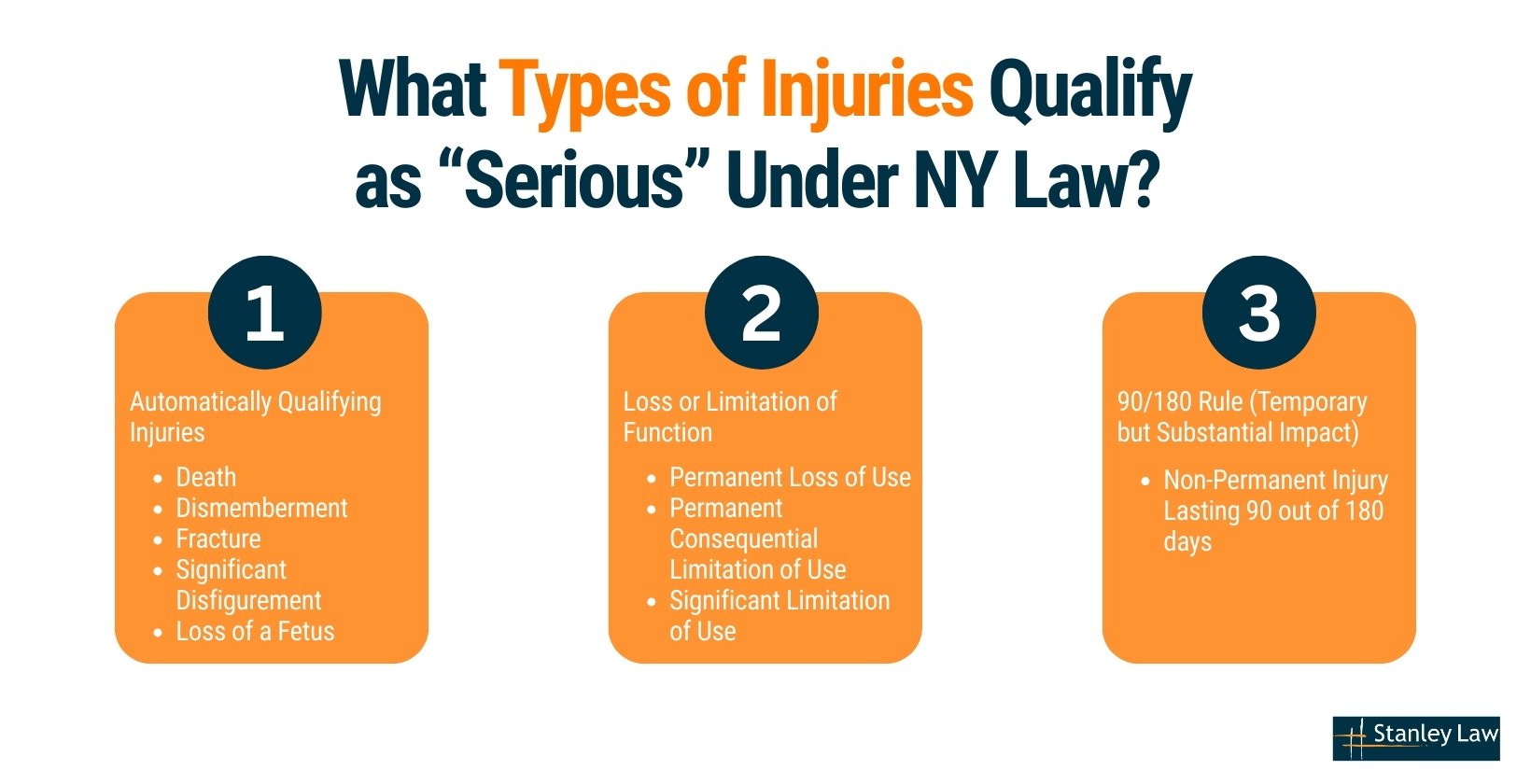

Automatically Qualifying Injuries:

Death

If the crash results in the loss of life, the threshold is automatically met. Surviving family members may pursue a wrongful death claim.

Dismemberment

If you lose a body part such as an arm, leg, finger, or toe, the law automatically treats this as a serious injury. Dismemberment refers to physical removal or amputation after trauma.

Fracture

Any broken bone, no matter the location or severity, meets the threshold. This includes simple fractures, complex breaks, or crushed bones.

Significant Disfigurement

Visible scarring, burns, or facial injuries that permanently alter your appearance may qualify.

Loss of a Fetus

If a crash causes a miscarriage or pregnancy loss, it is considered a serious injury.

Loss or Limitation of Function:

Permanent Loss of Use

Even if a body part remains intact, it still qualifies as a serious injury if it completely loses its ability to function. For example, nerve damage that paralyzes your arm or vision loss in one eye would meet this standard even though nothing was physically removed.

Permanent Consequential Limitation of Use

A lasting, medically diagnosed limitation in how a body part functions. For example, reduced mobility after knee surgery that doesn’t fully heal.

Significant Limitation of Use

Even if not permanent, this covers injuries that severely restrict physical ability, like range of motion loss, chronic joint pain, or ongoing neurological symptoms.

90/180 Rule (Temporary but Substantial Impact):

Non-Permanent Injury Lasting 90 out of 180 days

If you are substantially unable to perform normal daily activities for at least 90 days within the 180 days following the accident, this meets the threshold. If your injury isn’t listed here exactly but you’ve had long-term limitations, multiple months off work, or ongoing medical treatment, you may still qualify. What matters most is how the injury affects your daily life and how well that’s documented.

Who Decides if an Injury Meets the Serious Injury Threshold?

Whether your injury qualifies as “serious” under New York law is ultimately a legal question, decided through the court process, not by the insurance company. Here’s how that decision is made:

Judge vs. Jury

In many personal injury cases, a judge may decide early on whether your injury meets the legal threshold. If there’s disagreement about the facts, such as the extent of your medical limitations, a jury may decide instead. That’s why strong medical documentation is essential from the start.

You Carry the Burden of Proof

The law puts the responsibility on you, the injured party, not the insurance company. You must prove that your injury meets one or more of the qualifying categories listed in New York Insurance Law §5102(d).

Medical Records and Expert Testimony

Judges and juries rely heavily on objective proof like MRIs, treatment records, and expert testimony. Clear documentation from doctors is often what determines whether your injury is legally considered “serious.”

What Is Basic Economic Loss and How Does It Impact Threshold Cases?

Basic Economic Loss (BEL) is the foundation of New York’s No-Fault insurance system. It provides up to $50,000 in automatic coverage for medical bills, lost wages, and certain out-of-pocket expenses after a car accident, regardless of who caused it.

Once that amount is exhausted, your ability to seek additional compensation like pain and suffering depends on whether your injury meets the serious injury threshold under §5102(d).

The $50,000 Coverage Limit

The $50,000 cap includes:

- Medical costs: Doctor visits, hospital stays, physical therapy, and other treatment directly related to the injury.

- Lost wages (80%): Reimbursement for 80% of lost income, up to the coverage limit.

- Household help: Up to $25 per day for necessary services, like childcare or cleaning, if the injury prevents you from managing daily tasks.

BEL sounds helpful, and it is, but it doesn’t take much for serious injuries to exceed it. One surgery or several months out of work can wipe it out quickly.

Optional Basic Economic Loss

Optional Basic Economic Loss (OBEL) is additional No-Fault coverage that extends your benefits beyond the $50,000 default. This add-on must be selected when you buy or renew your auto insurance policy.

OBEL may include:

- Additional coverage for medical bills

- Extended wage replacement

- Additional in-home care or rehabilitation services

But even if you have OBEL, your right to sue for non-economic damages (like emotional distress or physical pain) still depends on meeting the serious injury criteria under §5102(d).

Why Exceeding $50K Makes the Threshold Legally Relevant?

Once your expenses surpass the coverage cap, New York law shifts your case from automatic benefits to litigation rules. At that point, any claim for pain and suffering or emotional distress hinges on proving that your injury qualifies under §5102(d) and is permitted under §5104(b).

For example, if you needed spinal surgery after a crash, and your recovery kept you out of work for four months, you’ve likely exceeded your No-Fault limit. If the injury also affects your mobility or quality of life long-term, that combination may justify a lawsuit against the at-fault driver.

What Is the 90/180 Rule and How Is It Evaluated?

Not all serious injuries are permanent, but if they substantially disrupt your daily life for a period of time, they may still meet New York’s legal threshold.

That’s where the 90/180 rule comes in.

What the Law Requires

Under New York Insurance Law §5102(d), you may qualify to file a lawsuit if:

Your injury prevents you from doing your normal daily activities for at least 90 days during the 180 days immediately after the accident.

These days don’t have to be in a row, but they must fall within that 6-month period after the crash.

How the Rule Is Evaluated?

It’s not just about the diagnosis; it’s about your ability to function. Courts look at how your injury affects your life, both physically and mentally.

Examples of qualifying limitations include:

- Inability to return to work

- Not being able to drive or commute alone

- Needing help with cooking, cleaning, or errands

- Loss of mobility, strength, or stamina

- Dependence on others for personal care or hygiene

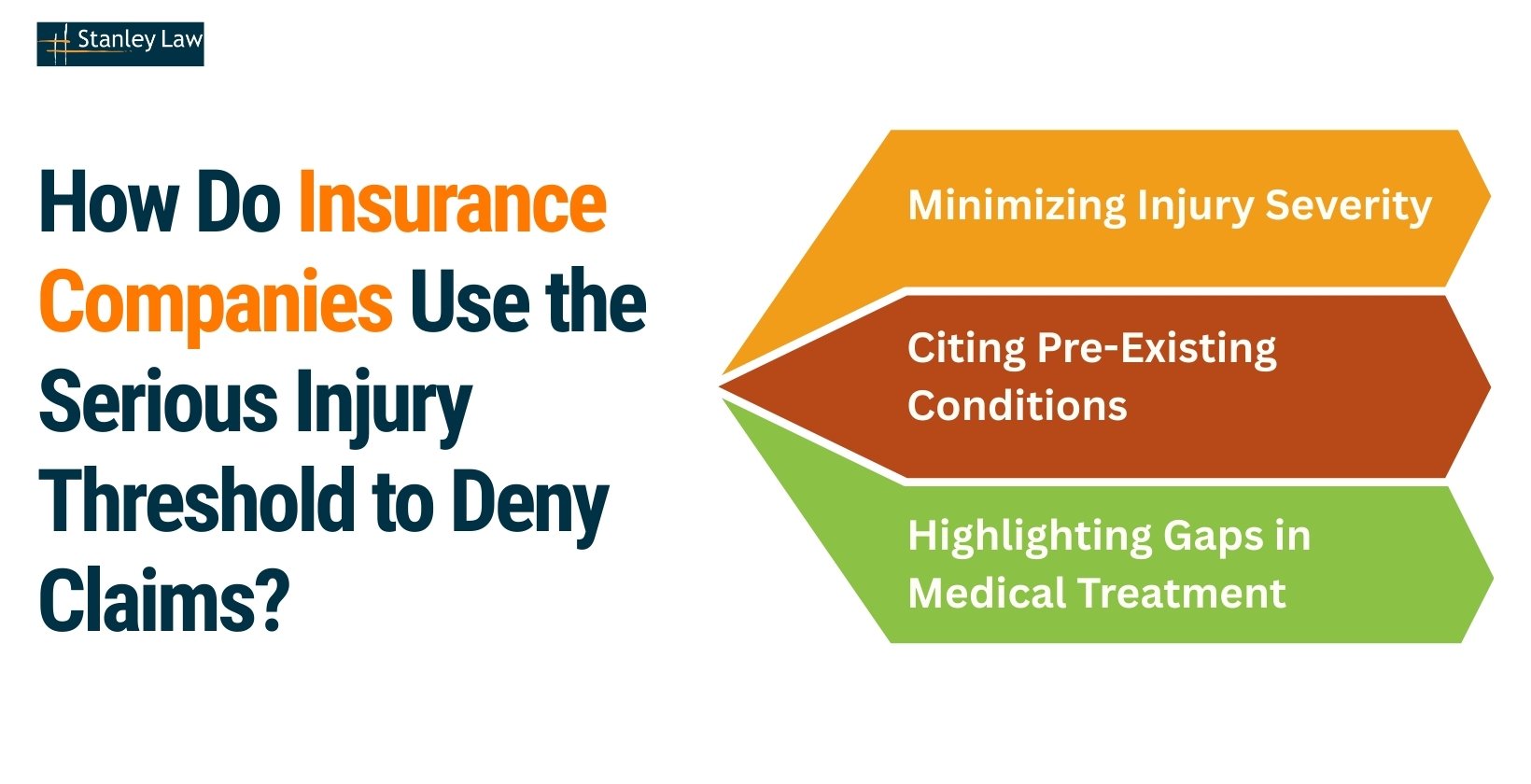

How Do Insurance Companies Use the Serious Injury Threshold to Deny Claims?

Insurance companies often rely on the serious injury threshold as a tool to reject or reduce claims, especially for non-economic damages like pain and suffering. Even when you’re genuinely hurt, they may argue your injuries don’t meet the legal standard under §5102(d). Here are the most common tactics they use and how to protect your case:

Minimizing Injury Severity

Insurers may downplay your injuries by labeling them as minor, soft-tissue conditions, like sprains or strains. They argue these don’t meet the threshold because they’re temporary and don’t significantly impair daily life.

What you can do:

- Follow up regularly with your doctor.

- Document functional limitations (not just pain).

- Keep records of how the injury affects your job, mobility, and daily activities.

Example: A driver diagnosed with whiplash is told their injury doesn’t qualify, even though they’ve experienced chronic pain for weeks. Regular medical follow-ups and documented treatment can help push back against this tactic.

Citing Pre-Existing Conditions

Another common defense is blaming your symptoms on conditions you had before the crash. Insurers may point to old injuries, arthritis, or chronic back issues as unrelated.

What your legal team may use to fight back:

- MRI or X-ray comparisons from before and after the accident.

- Detailed doctor notes showing new or worsened symptoms.

- Past treatment records proving the prior condition was stable or inactive.

Highlighting Gaps in Medical Treatment

Insurers may claim that delays or inconsistencies in care mean the injury wasn’t serious. They argue that if the injury were truly severe, you would have sought treatment immediately and stuck with it. To protect your claim, take these steps:

- Go to all scheduled appointments.

- Explain any missed visits in writing.

- Keep a journal of symptoms and limitations.

- Ask your doctor to document functional restrictions clearly.

Missing care or leaving gaps in your records can give insurers room to deny coverage, even if the injury is legitimate.

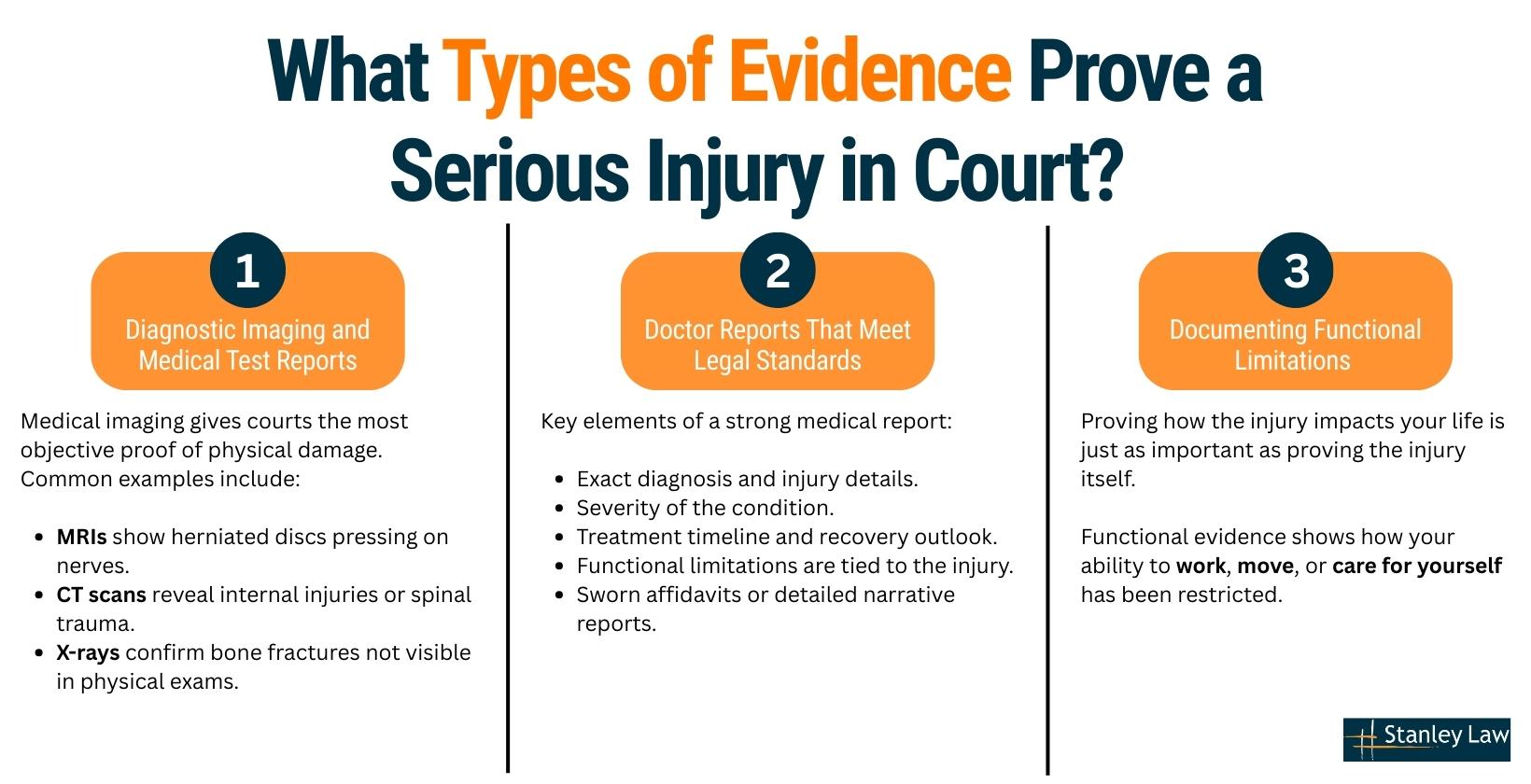

What Types of Evidence Prove a Serious Injury in Court?

To qualify under New York’s serious injury threshold (§5102(d)), it’s not enough to say you’re hurt; you must prove it with objective, documented evidence. Courts want to see not just what happened, but how it has limited your ability to live and work.

Diagnostic Imaging and Medical Test Reports

Medical imaging gives courts the most objective proof of physical damage. Common examples include:

- MRIs show herniated discs pressing on nerves.

- CT scans reveal internal injuries or spinal trauma.

- X-rays confirm bone fractures not visible in physical exams.

These images often carry more weight in court than pain complaints alone because they show measurable, physical harm.

Doctor Reports That Meet Legal Standards

A general doctor’s note isn’t enough. Courts look for detailed written reports that directly connect your diagnosis to how your life has changed. Key elements of a strong medical report:

- Exact diagnosis and injury details.

- Severity of the condition.

- Treatment timeline and recovery outlook.

- Functional limitations are tied to the injury.

- Sworn affidavits or detailed narrative reports.

Reports that say only “patient is in pain” or “follow-up recommended” usually don’t meet the threshold.

Documenting Functional Limitations

Proving how the injury impacts your life is just as important as proving the injury itself. Functional evidence shows how your ability to work, move, or care for yourself has been restricted.

- Example 1: A construction worker with a knee injury can’t climb ladders, lift heavy materials, or stand for long periods. Medical notes show missed work, strength loss, and the need for rehab.

- Example 2: A parent fractures their wrist and can’t cook, clean, or lift their child for three months. Occupational therapy records show daily challenges and limitations.

In both cases, medical records connect the injury directly to functional loss, which is what New York law requires.

Can You File a Lawsuit Without Meeting the Serious Injury Threshold?

In most cases, no, you cannot file a personal injury lawsuit in New York unless your injury meets the legal definition of “serious” under §5102(d). This legal threshold determines whether you’re allowed to sue for non-economic damages, such as pain and suffering or emotional distress. Legal limits when the threshold isn’t met:

- Statutory restrictions under §5104: The law prohibits lawsuits for personal injuries arising from motor vehicle accidents unless the injury meets the definition of a serious injury.

- Rare exceptions for economic loss: If your financial losses exceed the Basic Economic Loss cap (generally $50,000), you may be able to sue for the excess, even without a qualifying injury.

- No eligibility for pain and suffering: You cannot claim compensation for emotional distress, inconvenience, or physical pain unless your injury satisfies the threshold standard.

How Does the Serious Injury Threshold Affect Car Accident Lawsuits in New York?

The serious injury threshold plays a central role in deciding whether your case can go to court and what types of compensation you can pursue. It’s not just a legal formality; it shapes your legal rights and case strategy from the start. Key ways the threshold impacts your lawsuit:

- Determines eligibility to sue: You must meet the threshold to step outside No-Fault and file a personal injury claim.

- Controls access to non-economic damages: Only qualifying injuries permit you to seek compensation for pain and suffering or emotional distress.

- Influences legal strategy: If your injury is borderline, your attorney may focus heavily on building medical evidence and documenting functional limitations to satisfy the threshold early in the case.

Does the Serious Injury Threshold Apply in All New York Auto Accidents?

No, it does not. While the serious injury threshold under §5102(d) applies to most car accidents in New York, there are specific exceptions under §5103 and §5104 of the Insurance Law. In certain situations, you may file a lawsuit without needing to prove a “serious injury.”

Motorcycle and Non-Covered Vehicle Claims

Motorcycles and similar vehicles are excluded from New York’s No-Fault system. As a result, the serious injury threshold doesn’t apply to these types of accidents.

Vehicles excluded from No-Fault coverage include:

- Motorcycles

- Mopeds

- Off-road recreational vehicles

- ATVs

- Electric scooters (in some cases)

If you were injured on a non-covered vehicle, you don’t need to meet the §5102(d) standard to sue the at-fault driver.

Out-of-State Drivers in NY Accidents

Drivers from other states involved in accidents while in New York may not be bound by the state’s No-Fault rules. Whether the threshold applies often depends on the driver’s insurance policy and state of residency.

Example: A New Jersey driver injured in a crash while visiting Manhattan may be able to sue the at-fault driver without meeting the serious injury threshold, especially if their insurance policy does not follow New York’s No-Fault structure.

Lawsuits Allowed Under §5104 NY Law

Some situations automatically allow lawsuits without needing to meet the threshold. These exceptions are written into §5104 of the Insurance Law and include:

- Wrongful death.

- Uninsured or underinsured drivers.

- Permanent loss of a body function or system.

These exemptions give injured parties immediate access to the court system without needing to prove that the injury meets the standard threshold criteria.

What Happens If You Don’t Meet the Serious Injury Threshold?

If your injury doesn’t meet New York’s serious injury threshold under §5102(d), you generally cannot sue for non-economic damages even if the other driver was clearly at fault.

That means you may be barred from seeking compensation for pain and suffering, emotional distress, or loss of enjoyment of life. But it doesn’t mean you’re out of options. You may still have paths to financial recovery or opportunities to strengthen your case.

No Eligibility for Pain and Suffering

Under §5104 of the New York Insurance Law, individuals who do not meet the serious injury threshold cannot sue for non-economic damages, including pain and suffering, emotional distress, or loss of enjoyment of life. This restriction applies even when another driver’s negligence caused the accident.

Reassessing Your Medical Records

Sometimes, valid injuries are denied simply because they were poorly documented. Before assuming your case is closed, take steps to review and strengthen your medical evidence:

- Request full diagnostic reports (including MRI, CT, and X-ray) from all treating providers.

- Obtain second opinions from specialists who can evaluate the long-term effects.

- Track missed work, physical restrictions, and daily limitations in writing.

- Document symptoms over time in a personal log or diary.

Exploring Alternative Compensation Options

Even if a lawsuit isn’t possible, several other forms of financial recovery may still be available:

- No-Fault (PIP) Benefits: Up to $50,000 for medical expenses, lost wages, and household help.

- Optional Basic Economic Loss (OBEL): If selected in your policy, OBEL may extend your coverage.

- Private Insurance: Your health insurance or short-term disability policy may help cover gaps.

- Workers’ Compensation: If you were working at the time of the crash, this may apply.

These benefits can help protect your short-term financial stability while you recover.

When Should You Contact a Lawyer About Serious Injury Threshold in NY?

Right away. Speaking to a New York personal injury lawyer early gives you a clear understanding of your legal rights and ensures that vital evidence, such as medical records, accident reports, and timelines, is preserved and presented correctly.

Injury claims in New York often fail not because the injury isn’t real, but because they were not documented or handled properly from the start. Contact a lawyer if:

- You’ve been diagnosed with a potentially serious injury: Early legal review ensures your medical records align with legal requirements.

- Your insurance claim is denied or disputed: A lawyer can challenge the denial and build your case for eligibility.

- You’re considering filing a lawsuit: Legal input before filing helps determine whether your injury meets New York’s threshold under §5102(d).

New York’s personal injury system leaves very little room for error. Missing the threshold even by a small margin can result in a complete loss of your right to compensation for pain and suffering.

If there’s any doubt about whether your injury qualifies, a free legal consultation with our lawyers can bring clarity and direction before the window to act closes.

FAQs About NY’s Serious Injury Threshold

Does a herniated disc meet NY’s serious injury threshold?

Yes. A herniated disc meets the serious injury threshold in NY if it causes a significant limitation of use or permanent impairment, supported by diagnostic imaging and detailed medical records under §5102(d).

Is a concussion considered a serious injury in New York?

It depends. A concussion is considered a serious injury in NY only if it leads to measurable cognitive limitations or prevents normal daily activities for 90 of 180 days after the accident.

Can soft tissue injuries qualify as serious injuries in NY?

Yes. Soft tissue injuries can qualify under NY’s serious injury threshold if they cause long-term functional limitations or disable daily activity for 90 days within 180 days post-accident.

Does the serious injury threshold apply to passengers?

Yes. The serious injury threshold in NY applies equally to passengers and drivers. Anyone seeking damages beyond No-Fault must meet the threshold requirements under §5102(d).

What’s the deadline for filing a claim if I meet the serious injury threshold?

The deadline is three years. In most New York personal injury cases, you must file within three years of the accident date. Shorter deadlines may apply in municipal or wrongful death cases.

Is surgery required to prove a serious injury?

No. Surgery is not required to prove a serious injury in NY. However, undergoing surgery can help establish the severity and long-term impact of the injury.

Is emotional distress considered a serious injury in NY?

No. Emotional distress alone is not considered a serious injury in NY. A qualifying physical injury is required before non-economic damages can be claimed.

What makes a car accident injury legally actionable in NY?

A car accident injury is legally actionable in NY if it exceeds $50,000 in basic economic loss and meets the serious injury threshold under §5102(d).

The Legal Significance of New York’s Serious Injury Threshold

New York’s serious injury threshold determines whether an accident victim can move beyond No-Fault coverage to pursue a full personal injury claim. It’s not just a legal formality – it’s what allows injured individuals to seek broader compensation for lasting harm.

At Stanley Law Offices, we help clients understand how this threshold applies to their unique situation. Clarifying that early often makes the difference between a closed claim and a valid case. Contact us.